One of the largest hardware wallet makers in the industry, Ledger, has made several exciting announcements recently. The statements were made by the company representatives at a special Ledger Op3n conference in Paris. One of the biggest announcements of the company was the unveiling of their new crypto debit cards.

As the Ledger VP of Payments, Iqbal Gandham noted, the new offering was released on the basis that there is a need for the crypto industry to focus on spendings. As the presentation noted, the debit card issued by the company will be a Visa card and will be released by Baanx. It is an affiliate of Contis Financial Services.

The debit card will be named Crypto Life card. It was also announced that the new debit card will support numerous different cryptocurrencies and it will also be available to be tracked through the Ledger Live. It is a software companion to the hardware wallets issued by the company.

During the conference, it was also announced that the company has already started a waitlist ahead of the exciting launch. According to Gandham, the debit card will be working in a very simple manner. It will convert to crypto at the point of sale, and the owners of the debit cards will also have the opportunity to request an interest-free credit line for as much as 30 days.

This will be based on the crypto they own. Another very exciting part of the recent announcement is that the company noted that the cardholders will have the opportunity to have their salaries sent to their accounts and have them automatically converted into cryptocurrencies.

Ledger, Coinbase & FTX – A New Collaboration

Amid the announcement of the new offering, the representatives of Ledger said that the offering would be available to clients as a result of a collaboration with Coinbase and FTX, one of the leading crypto exchanges in the industry.

To make things easier for individuals, Coinbase Wallet will be adding support for Ledger. The non-custodial wallet of Coinbase, called the Coinbase Wallet, is planning to provide special support for Ledger.

As a result of this collaboration, the users will be able to directly interact with blockchain applications using the web browser, while also using their hardware wallet. VP of product at Coinbase announced that they are already working on building support for hardware wallets within the non-custodial wallet.

According to him, this will start by offering a browser version of the wallet. Ledger also introduced FTX into the lineup, which will expand the trading options of Ledger. The first function available for clients will be the non-custodial swap.

Thanks to the collaboration with FTX, users will be offered full exchange functionally. As a result of this collaboration and partnership, those owning Ledger will no longer have the need to send their crypto to the exchanges for making trades.

Collaboration is very important for many traders around the world, as both Coinbase and FTX are very popular in the market. FTX is one of the largest crypto exchanges in the market, offering traders access to numerous digital assets.

Among many other great offerings that this exchange has for its clients is FTX automated trading opportunities. The clients of the company can use third-party robots to connect with their exchange account and let it analyze the market in a very short time.

By using an FTX trading bot, it is a lot easier for traders to invest in the market. You can simply go on with your day, while the bot makes profits for you. Also, trading robots can analyze huge amounts of data in a very short time, while, on the other hand, there always is some type of limitation for people when it comes to market analysis.

Ledger & Its Plans on NFT

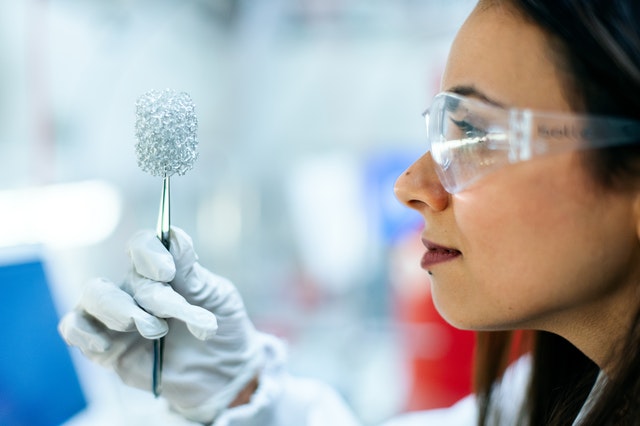

It was also noted that the company will be focused on securely and safely sending NFTs between the wallets. The VP of product at Ledger, Charles Hamel, announced that the company will be focused on making NFT transactions easier, as well as safer.

The currently used method is that individuals are basically blind sign their transactions, which means that they simply don’t see data they are agreeing to share, or see a huge amount of data.

The alternative was offered by Ledger, which is to break down the transactions and show everything that is going on on the mobile app of the company. A demo was shown by the company, which provided different types of details of the transaction. This included the destination address as well as the token that is being sent.

The company also announced that it has recently integrated the Rarible into Ledger Live. As a result, the owners of Ledger will be able to access the NFT market for making NFT transactions, while also using the hardware wallet.

The recent steps taken by the company for the future development of its services are very important. This will offer individuals the opportunity to stay connected with their Ledger wallets in a more convenient way and will simply make things a lot easier for them.