Second contract trading is an increasingly popular strategy for trading cryptocurrencies. It involves trading derivatives contracts, such as futures or options, rather than buying or selling the underlying asset. Second contract trading is an advanced strategy that requires a good understanding of cryptocurrency markets and derivatives trading. In this article, I’ll explore the ins and outs of second-contract trading in crypto, including its benefits, risks, strategies, and best practices.

I. Understanding Second Contract Trading

Second contract trading is a type of derivatives trading where investors buy or sell contracts based on the price of an underlying asset, such as a cryptocurrency. Derivatives are financial instruments that get their value from an underlying asset. They let investors gain exposure to the base asset without owning it. Traders often use second contract trading to protect their positions or make bets on how the price of the main asset will move.

A. Definition of Crypto Derivatives

Cryptocurrency derivatives are financial contracts that derive their value from the price of a cryptocurrency. They are traded on derivatives platforms and can be used to protect against changes in the price of cryptocurrencies or bet on how their prices will move. Futures, options, and swaps are all common types of Bitcoin derivatives.

B. Types of Crypto Derivatives

There are several types of cryptocurrency derivatives that can be traded, including:

1. Futures contracts: Futures contracts are agreement to buy or sell an underlying object at a certain price and time in the future. The price and time are set in advance. People often use them to protect their positions or bet on how prices will move.

2. Options contracts: Contracts for options are agreements that offer the buyer the right, but not the responsibility, to sell or sell an underlying asset at a preset price and time in the future. However, the buyer is not required to exercise this right or obligation. Options are a tool that can be utilized for hedging existing positions or for speculating on future price changes.

3. Swaps: Swaps are agreements to exchange cash flows based on the price of an underlying asset. They are often used to hedge positions or mitigate risk.

C. Understanding Second Contract Trading in Crypto

Second contract trading in crypto involves trading cryptocurrency derivatives contracts rather than buying or selling the underlying cryptocurrency. For example, a trader could buy a Bitcoin futures contract that expires in three months at a price of $50,000. If the price of bitcoin increases to $60,000 by the expiration date, the trader will make a profit of $10,000. If the price of bitcoin decreases, the trader will lose money.

II. Benefits of Second Contract Trading in Crypto

Second contract trading in crypto offers several benefits to traders, including:

A. Increased Liquidity

The markets for cryptocurrency derivatives are quite liquid, which means that there are a large number of sellers and buyers participating in the market. Traders will find that it is simpler to enter and exit positions quickly and at reasonable prices as a result of this.

B. Reduced Volatility

Cryptocurrency derivatives markets can help reduce volatility in the underlying cryptocurrency market. By allowing traders to hedge their positions or speculate on price movements, derivatives markets can help stabilize prices and reduce market volatility.

C. Improved Market Efficiency

Derivatives markets can help improve market efficiency by providing more accurate price signals and reducing market inefficiencies. This can help traders make more informed trading decisions and increase market liquidity.

D. Potential for Higher Returns

Second contract trading in crypto can offer the potential for higher returns than trading the underlying cryptocurrency. Because derivatives contracts are leveraged, traders can control a larger amount of the underlying asset with a smaller amount of capital. This can amplify returns, but it also increases the risk of losses.

III. Risks of Second Contract Trading in Crypto

Second contract trading in crypto also carries several risks, including:

A. Market Risk

Second contract trade in crypto has market risk, just like any other type of trading. The price of cryptocurrencies and the derivatives contracts that are based on them can be affected by a wide range of things, such as market opinion, economic and political changes, and technological advances. Before getting into second contract trading in crypto, traders should be aware of the risks and have a good grasp of how the market works.

B. Counterparty Risk

Counterparty risk occurs when a derivatives contract’s other party fails to perform. If the other party defaults, declares bankruptcy, or cannot fulfill their contractual responsibilities, this can happen. Derivatives traders should be aware of counterparty risk and seek reliable counterparties.

C. Regulatory Risk

Regulatory risk is the possibility that legal changes could lower derivatives contracts or cryptocurrency values. Global governments and regulatory organizations are still trying to regulate cryptocurrencies and their derivatives, which could affect the market.

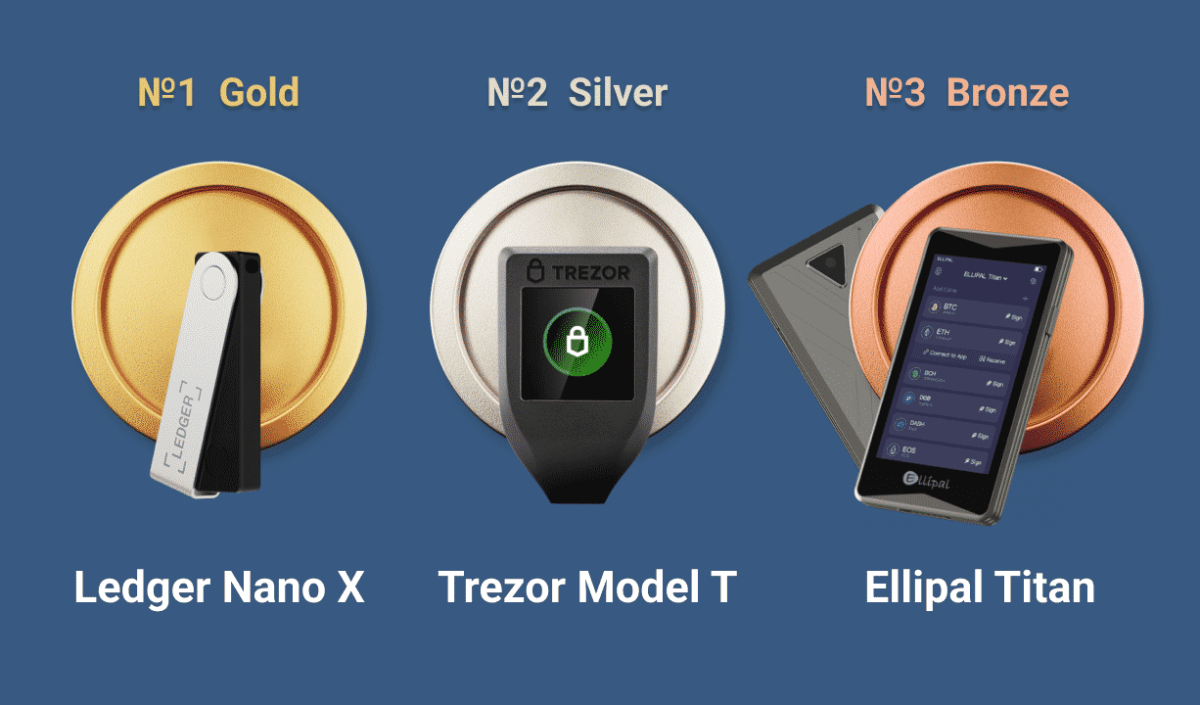

D. Technology Risk

Technology risk refers to the risk that the technology used to trade derivatives contracts could fail or be compromised, leading to losses for traders. Traders should be aware of the technology risks involved in trading derivatives contracts and should take steps to protect their assets and data.

IV. Strategies for Successful Second Contract Trading in Crypto

To be successful at second contract trading in crypto, traders should have a well-defined trading strategy that takes into account market conditions, risk management, and position sizing. Some key strategies include:

A. Fundamental Analysis

Fundamental analysis examines the elements that drive cryptocurrency and derivatives values. Quantity, demand, technology, and new restrictions can cause this.

B. Technical Analysis

Technical analysis involves analyzing price charts and market data to identify trends and patterns that can be used to make trading decisions. Technical analysis can be used to identify entry and exit points, as well as to set stop-loss orders and profit targets.

C. Risk Management

Risk management is a key part of a second contract dealing in crypto that you can’t do without. Traders should know how much risk they are willing to take and use risk management tools like stop-loss orders and account sizing to keep their losses as low as possible.

D. Diversification

Diversification is the practice of spreading out investments across different assets or markets to reduce risk. Traders can diversify their second contract trading in crypto by trading multiple cryptocurrencies or derivatives contracts across different markets.

V. Best Practices for Second Contract Trading in Crypto

To be successful at second contract trading in crypto, traders should follow best practices that help them stay informed, disciplined, and focused. Some key best practices include:

A. Research and Education

Traders should stay informed all the time about the latest developments in the cryptocurrency and derivatives markets by reading news articles, market reports, and research papers. Traders should also seek out educational resources to learn more about trading strategies, risk management, and market dynamics.

B. Discipline and Patience

Discipline and patience are vital qualities for successful second contract trading in crypto. Traders should have a well-defined trading plan and should stick to it, even when market conditions are challenging. Traders should also be patient and avoid making impulsive trading decisions.

C. Keeping Emotions in Check

Emotions have the potential to impair judgment and result in poor business choices. Traders should do their best to keep their emotions under control and steer clear of letting greed or fear dictate their trading selections.

D. Monitoring Market Trends and News

Traders should stay aware of market trends and news that could impact the price of cryptocurrencies and their derivatives contracts. Traders can use social media, news websites, and market analysis tools to stay up-to-date on the latest market developments.

Conclusion

Second contract trading in crypto can be a lucrative strategy for experienced traders, but it also carries significant risks. Traders should have a good understanding of market dynamics, risk management, and trading strategies to be successful in this market. They should also follow best practices such as staying informed, disciplined, and focused on maximizing their chances of success.

While second contract trading in crypto is still a relatively new and rapidly evolving market, it offers traders a range of opportunities to profit from the volatility of cryptocurrencies.

By following best practices and implementing sound trading strategies, traders can minimize their risk exposure and increase their chances of success in the highly competitive and dynamic world of second contract trading in crypto.