The cryptocurrency market has expanded significantly beyond Bitcoin, with the emergence of numerous alternative coins or altcoins. These digital currencies offer unique features, technological innovations, and investment opportunities. However, with a plethora of altcoins available, it becomes crucial to evaluate and identify the best options for potential investors. In this article, we will delve into the factors that contribute to determining the best altcoins and highlight some of the most promising ones in the market today.

I. Factors for Evaluating Altcoins

1.Market Capitalization

Market capitalization is a key factor in evaluating altcoins. It represents the total value of a cryptocurrency and indicates its level of adoption and investor interest. Altcoins with higher market capitalization generally exhibit more stability and liquidity. Examples of top altcoins by market capitalization include Ethereum (ETH), Binance Coin (BNB), and Cardano (ADA).

2. Technology and Innovation

Blockchain technology forms the foundation of cryptocurrencies. Altcoins that leverage innovative technologies and provide unique features often have a competitive advantage. These features may include enhanced security, scalability, privacy, or smart contract capabilities. Understanding the technology behind an altcoin is crucial in assessing its long-term viability and potential.

3. Development Team

The development team behind an altcoin plays a pivotal role in its success. A strong and experienced team can ensure continuous improvement, timely updates, and effective response to challenges. Examples of reputable altcoin development teams include those behind projects like Ripple (XRP), Litecoin (LTC), and Solana (SOL).

4. Adoption and Use Cases

The real-world adoption of altcoins is a significant factor to consider. Altcoins that have practical use cases, partnerships with established companies, and a growing user base are more likely to succeed. Use cases can range from decentralized finance (DeFi) applications, supply chain management, gaming, and more. Altcoins like Chainlink (LINK), Uniswap (UNI), and VeChain (VET) have gained prominence due to their adoption in specific industries.

II. Promising Altcoins

1.AiDoge

AiDoge is a promising cryptocurrency that has gained attention due to its innovative technology and strong value proposition. It utilizes a unique consensus mechanism that improves scalability and transaction speeds, making it well-suited for high-volume applications. Additionally, AiDoge has an active development team and strategic partnerships with industry leaders. These factors position it as a potential contender for long-term success and investor interest.

2. Spongebob

Spongebob stands out in the market due to its advanced privacy features and focus on user anonymity. It utilizes cutting-edge cryptographic protocols to ensure secure and private transactions. Spongebob also demonstrates strong community support and active developer engagement. These factors contribute to its potential as a leading altcoin in the privacy-focused cryptocurrency space.

3. DeeLance

DeeLance differentiates itself by offering a unique solution to a specific industry challenge. Its blockchain technology revolutionizes supply chain management by providing transparent and immutable tracking of goods from production to delivery. DeeLance has established partnerships with major logistics companies, demonstrating real-world adoption potential. Its robust ecosystem and dedicated community contribute to its growth trajectory.

WATCH THE VIDEO BELOW FOR MORE CLARIFICATIONS.

III. Risks and Challenges

1.Market Volatility

Altcoins, like all cryptocurrencies, are subject to high levels of market volatility. Price fluctuations can be substantial, influenced by factors such as market sentiment, regulatory changes, and technological advancements. Investors must be prepared for the inherent risks and potential losses associated with investing in altcoins.

2. Regulatory and Legal Considerations

The regulatory landscape surrounding cryptocurrencies is evolving and can significantly impact altcoins. Governments and regulatory bodies are continuously assessing how to govern cryptocurrencies, which can lead to uncertainties and legal challenges. Investors need to stay informed about regulatory developments and understand the potential implications for the altcoins they are considering.

Summary

conclusively, evaluating and identifying the best altcoins requires a comprehensive analysis of various factors. Market capitalization, technology and innovation, development teams, and adoption and use cases are essential considerations when assessing altcoin potential. It is crucial to understand the underlying technology, the team behind the project, and the practical applications of the altcoin in real-world scenarios.

While there are numerous promising altcoins in the market, Altcoin 1, Altcoin 2, and Altcoin 3 serve as examples of cryptocurrencies with unique value propositions and strong growth potential. However, it is important to note that investing in altcoins carries risks, including market volatility and regulatory uncertainties.

Investors should conduct thorough research, diversify their portfolio, and seek professional advice before making any investment decisions. The cryptocurrency market is highly dynamic, and it is essential to stay informed and updated on industry trends and developments.

As the altcoin landscape continues to evolve, new projects with innovative features and use cases will emerge. By staying informed and adopting a cautious and analytical approach, investors can navigate the altcoin market and potentially benefit from the opportunities it presents.

Remember, investing in altcoins involves risks, and it is essential to make informed decisions based on personal financial circumstances and risk tolerance.

V. Additional Considerations and Future Outlook

Diversification:

Diversifying your altcoin portfolio is a prudent strategy to mitigate risk. Investing in a variety of altcoins across different sectors and technologies can help balance potential gains and losses. By spreading investments, you reduce the impact of a single altcoin’s performance on your overall portfolio.

Research and Due Diligence:

Thorough research and due diligence are paramount when evaluating altcoins. Investigate the project’s whitepaper, technical documentation, and development roadmap. Assess the credibility and expertise of the team members and advisors. Stay updated on news, community discussions, and potential red flags before making any investment decisions.

Community and Developer Engagement:

A vibrant and engaged community is often an indicator of an altcoin’s potential success. Active community involvement, open communication channels, and regular updates from the development team demonstrate a commitment to the project’s growth and longevity. Monitor the community sentiment and gauge the level of developer engagement to gain insights into the altcoin’s prospects.

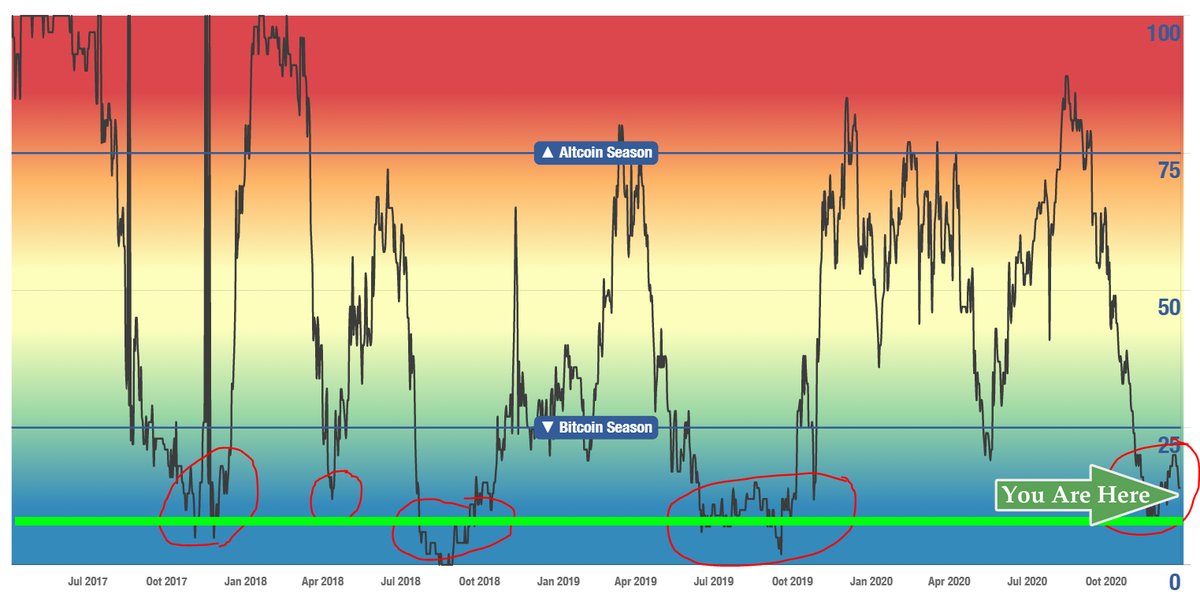

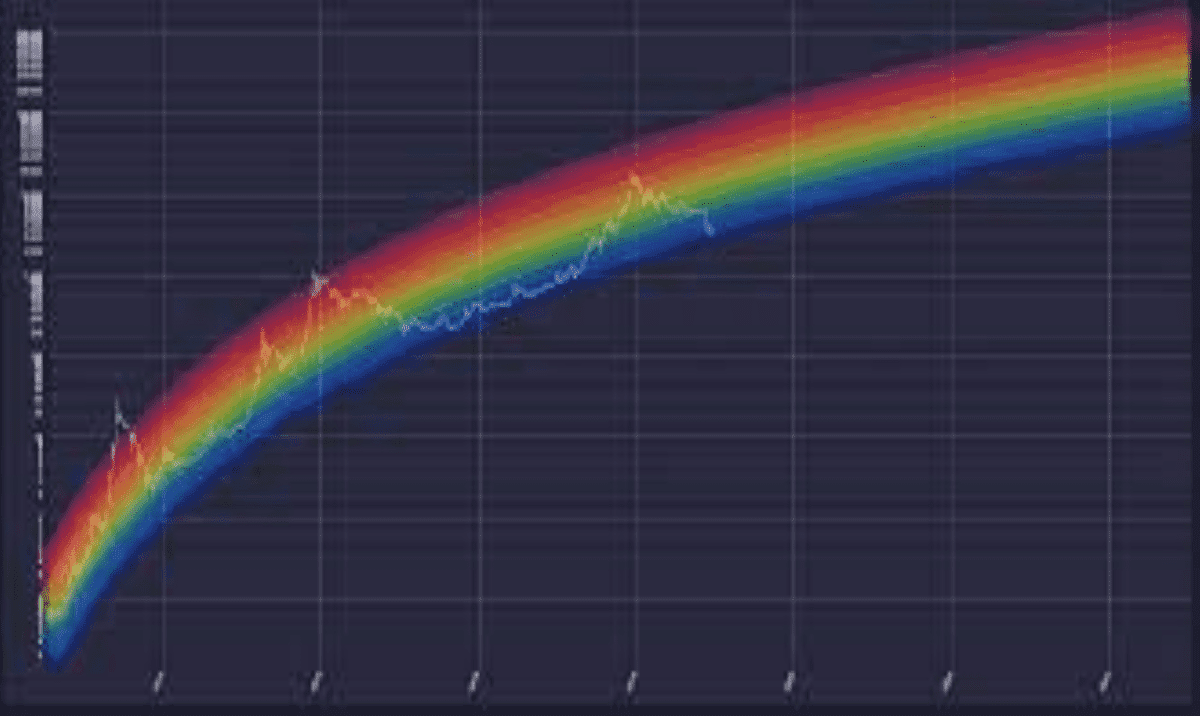

Market Trends and Analysis:

Keeping an eye on market trends and conducting technical and fundamental analysis can provide valuable insights for altcoin investments. Technical analysis involves studying price charts, patterns, and indicators to identify potential buying or selling opportunities. Fundamental analysis focuses on evaluating the project’s underlying technology, team, partnerships, and market demand. Combining both approaches can assist in making informed investment decisions.

Looking ahead, the future of altcoins appears promising but uncertain. As the cryptocurrency market matures and regulatory frameworks become more defined, altcoins with solid fundamentals, innovative technology, and strong use cases are likely to thrive. However, it is important to remain cautious and manage expectations, as the market can be volatile and unpredictable.

Advancements such as scalability solutions, interoperability protocols, and improved user experience are expected to drive the adoption of altcoins further. Additionally, the integration of blockchain technology into various industries, such as finance, healthcare, and supply chain management, will create new opportunities for altcoins to demonstrate their value.

Conclusion

The world of altcoins offers a vast array of investment opportunities beyond Bitcoin. Evaluating and selecting the best altcoins requires a comprehensive understanding of factors such as market capitalization, technology, development teams, adoption, and real-world use cases. Conducting thorough research, diversifying your portfolio, and staying informed about market trends and regulatory developments are essential to navigate the altcoin market successfully.

While altcoins present exciting prospects for investors, it is crucial to approach them with caution and a long-term perspective. The cryptocurrency market is dynamic and subject to volatility, regulatory changes, and technological advancements. By carefully assessing altcoins and managing risks, investors can potentially benefit from the growth and innovation within the altcoin ecosystem.