David Agullo

What is Uniswap And Why invest in Uniswap?

What is Uniswap?

Uniswap is the biggest decentralized trade in the crypto space. Uniswap influences many crypto resources, including its local UNI cryptocurrency, to offer a support like a traditional exchange. The thing that matters is, Uniswap has no central administrator or operator, making it completely decentralized.

Unlike most exchanges, which are intended to take charges, Uniswap is intended to work as a public decent — a tool for the local area to exchange tokens without brokers. Likewise, unlike most trades, which match purchasers and vendors to decide costs and execute exchanges, Uniswap utilizes a basic maths equation, pools of tokens, and Ethereum (ETH) to do similar work.

Since Uniswap is based on Ethereum, it can’t list tokens based on other blockchains, and in this way, users can just swap ERC-20 tokens.

Why put resources into Uniswap?

Decentralized exchange development

With the ascent of decentralized finance (DeFi), decentralized trades have seen tremendous development over the last year. The decentralized trade volume has developed to $404.9 billion in the quarter of 2021. This is an increase of 118x year-on-year. It is the biggest and best decentralized trade, representing more than half of the weekly volume.

Revenues

Uniswap has an everyday revenue that is multiple times more prominent than Bitcoin and is presently the second-biggest digital currency in terms of revenue, behind Ethereum. This income permits Uniswap to be esteemed by conventional money metrics and gives it a more noteworthy conviction for higher valuations and longevity as a steady task.

Decentralized exchange exposure

Uniswap is the world’s biggest decentralized exchange digital currency. It is, thusly, a definitive resource for purchase in case you are looking to acquire exposure to this universe.

Potential oracle solution

It could turn out to be something other than a decentralized trade. Because of its extraordinary nature and achievement, it is discovering utility for different purposes. Vitalik Buterin – Ethereum founder – recently recommended that it become an oracle token, giving solid value feeds to the smart contracts. Uniswap is appropriate for this reason because of its profound liquidity and substantial use, ensuring that costs are not manipulatable on the convention, and others can profit from these attributes. This will help the environment, as it will also decentralize the oracle space presently dominated by Chainlink.

Solid community and value performance

Uniswap is integrated with almost all major DeFi conventions because of its significance in giving a core DeFi usefulness of resource exchange. Because of these, it has developed a solid community of supporters. Since its beginning, the UNI token has performed amazingly well, with returns in the abundance of 700%.

Uniswap’s Performance

Since the initiation of Uniswap, we have seen it develop at an astounding rate. This development has been driven by two variables:

- The developing interest in the general digital currency market.

- The developing interest in the DeFi area, in which it is the greatest player.

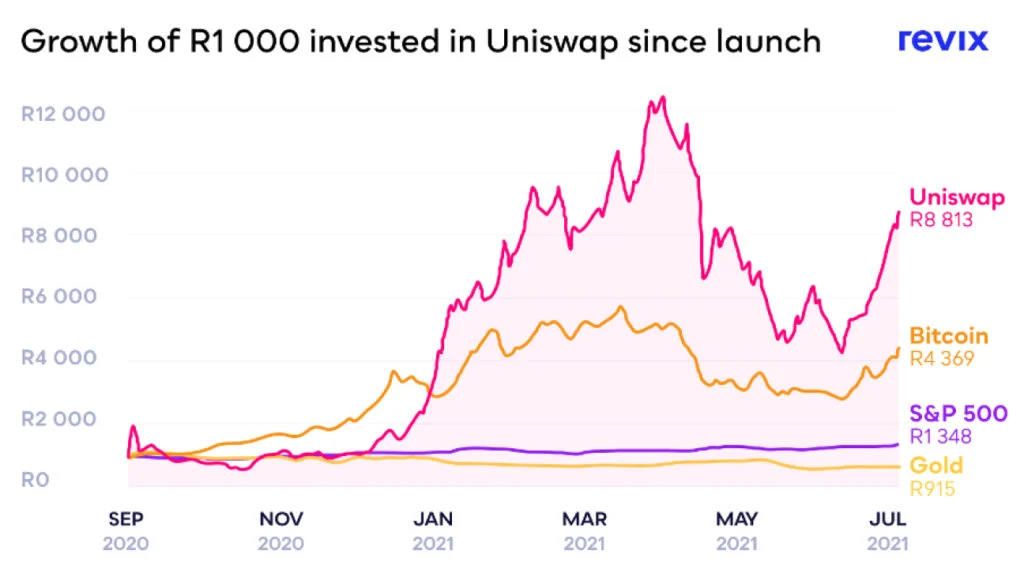

Below we can perceive how Uniswap has beaten numerous other venture resources since the end of its initial exchanging day.

A solitary R1 000 interest in it would have converted into + R8 813. This is significant when compared to numerous other speculations. Indeed, gold would have lost you money over a similar period (your R1 000 speculation would be worth R915).

Latest

DeFi News

09 May 2024

DeFi News

19 Apr 2024

DeFi News

16 Jan 2024

DeFi News

31 Aug 2023

DeFi News

24 Jun 2023

DeFi News

24 Jun 2023