The world of cryptocurrency is constantly evolving, and with the rise of new digital currencies comes the potential for economic growth and disruption. One such cryptocurrency that has gained attention in recent years is Shiba Inu, which was created as a meme-inspired alternative to other popular cryptocurrencies like Bitcoin and Ethereum. Despite its whimsical origins, Shiba Inu has made significant strides in the cryptocurrency market and even garnered attention from the World Economic Forum. In this article, we will examine the potential impact of Shiba Inu at the World Economic Forum and what it could mean for the global economy.

I. Shiba Inu World Economic Forum

A. Explanation of Shiba Inu cryptocurrency

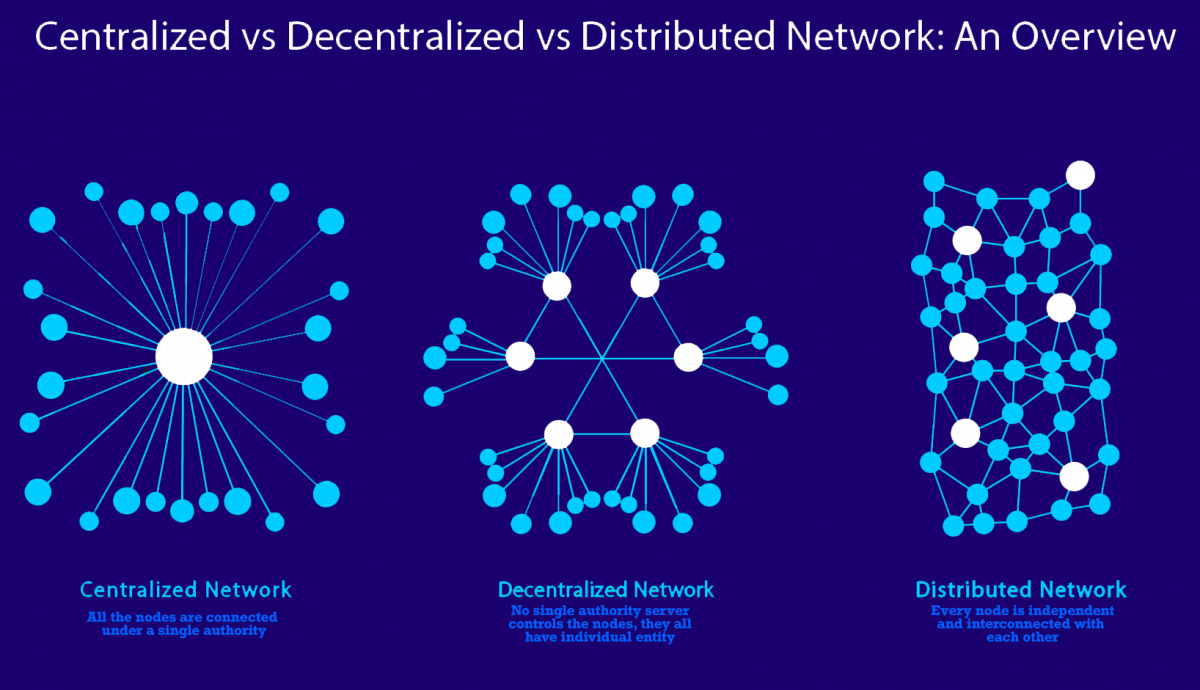

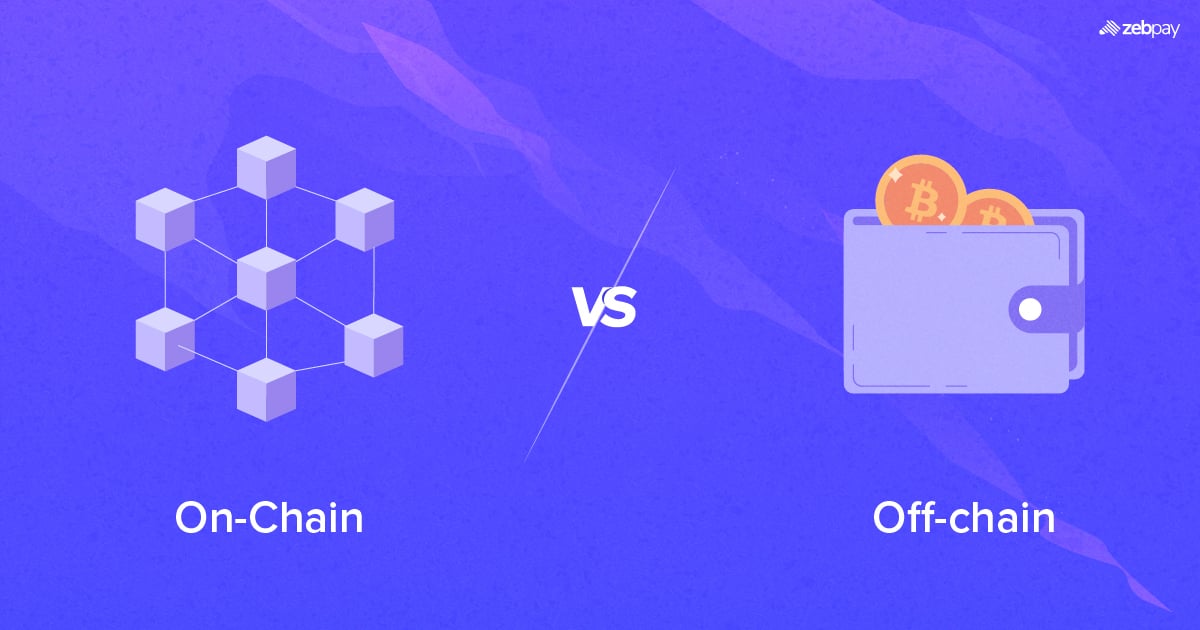

Shiba Inu is a cryptocurrency that was created in August 2020 by an anonymous person or group of people under the pseudonym “Ryoshi.” The currency is named after the Shiba Inu dog breed, which gained popularity as an internet meme. Like other cryptocurrencies, Shiba Inu operates on a decentralized platform using blockchain technology, which allows for secure and transparent transactions without the need for intermediaries like banks or governments.

B. Overview of the World Economic Forum

The World Economic Forum is an annual event that brings together leaders from the worlds of business, politics, and academia to discuss important economic issues facing the global community. Founded in 1971, the Forum has grown into a platform for networking, knowledge sharing, and problem-solving and has gained a reputation as a forum for innovative and forward-thinking ideas.

II. Shiba Inu’s Impact on the Cryptocurrency Market

A. Market share and valuation

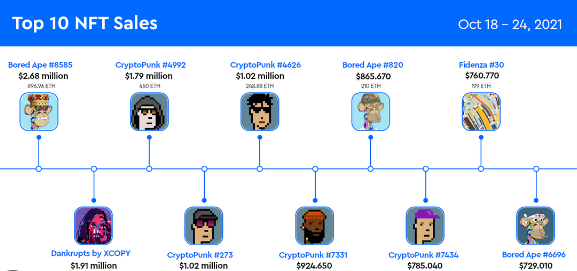

Shiba Inu has made significant gains in the cryptocurrency market since its creation and currently has a market capitalization of over $3 billion. This places it in the top 30 cryptocurrencies by market capitalization, which is impressive considering the currency’s relatively short lifespan.

B. Adoption by investors and traders

Shiba Inu’s popularity has grown rapidly due in part to its low barrier to entry for investors and traders. The currency is currently available on a number of cryptocurrency exchanges, making it easily accessible to anyone interested in purchasing or trading it.

C. Comparison to other cryptocurrencies

Shiba Inu’s rise in popularity can be attributed in part to its unique branding and marketing strategy. Unlike other cryptocurrencies that focus on serious, technical aspects of blockchain technology, Shiba Inu’s branding is lighthearted and fun, with a focus on memes and internet culture. This has helped the currency gain a following among younger investors and traders who are drawn to its playful nature.

III. Shiba Inu at the World Economic Forum

A. Explanation of Shiba Inu’s presence

In recent years, cryptocurrencies have gained increasing attention from the World Economic Forum as leaders recognize the potential impact of these digital currencies on the global economy. In 2021, Shiba Inu was mentioned in a report from the Forum titled “Crypto, What Is It Good For? An Overview of Cryptocurrency Use Cases.” This report highlights the potential uses of cryptocurrency and blockchain technology in various sectors of the economy and specifically mentions Shiba Inu as an example of a “memecoin” that has gained traction in the market.

B. Discussion of the importance of the World Economic Forum

The World Economic Forum is an important platform for discussing and addressing global economic issues, and its recognition of Shiba Inu signals a growing interest in the potential of cryptocurrencies in the global economy. The Forum’s discussions and reports have the potential to influence policy decisions and investment strategies, making its recognition of Shiba Inu a significant step in legitimizing the currency’s role in the broader economic landscape.

C. Shiba In u’s potential impact on the global economy

Shiba Inu’s recognition at the World Economic Forum signals a potential shift in the way that cryptocurrencies are viewed in the broader economic landscape. Cryptocurrencies have often been viewed with skepticism and mistrust by governments and traditional financial institutions, but the growing acceptance and recognition of cryptocurrencies like Shiba Inu suggest that this attitude is changing. As cryptocurrencies become more mainstream and are adopted by larger institutions and investors, they could have a significant impact on the global economy.

IV. Opportunities and Challenges

A. Opportunities for Shiba Inu

Shiba Inu is a cryptocurrency that has gained significant attention and popularity since its creation in 2020. While it faces challenges like any cryptocurrency, there are also a number of opportunities for Shiba Inu in the cryptocurrency market. Here are five potential opportunities for Shiba Inu:

Integration into global financial systems

One of the biggest opportunities for Shiba Inu is the potential for integration into global financial systems. As cryptocurrencies become more widely adopted, there is a growing need for interoperability between different currencies and financial systems. If Shiba Inu can establish itself as a viable and trustworthy currency, it could potentially play a role in the global financial ecosystem. For example, it could be used for cross-border transactions or as a store of value for investors looking to diversify their portfolios.

Increased legitimacy and adoption

Another opportunity for Shiba Inu is the potential for increased legitimacy and adoption. As the currency gains recognition and acceptance from larger institutions, it could become more widely adopted by investors and traders, which could, in turn, drive up its value and market share. In addition, as more people become aware of Shiba Inu and its unique branding, it could become a popular choice for those looking to invest in cryptocurrencies.

Branding and marketing opportunities

Shiba Inu’s unique branding as the “Dogecoin killer” has helped it stand out in a crowded cryptocurrency market. Its association with the popular meme of the Shiba Inu dog has also helped to build a strong community of supporters. This branding and marketing potential could be leveraged to further promote the currency and build its user base.

Innovation potential

Cryptocurrencies like Shiba Inu are still in the early stages of development, and there is potential for innovation and new use cases to emerge. For example, Shiba Inu could be used as a means of payment for online purchases or as a way to reward users for participating in social media platforms or other online communities. As more people experiment with cryptocurrencies and blockchain technology, new use cases and innovations are likely to emerge.

Potential for value appreciation

Finally, Shiba Inu has the potential for significant value appreciation, which could be an opportunity for investors. While cryptocurrencies are notoriously volatile, there have been examples of currencies like Bitcoin and Ethereum experiencing significant value appreciation over time. If Shiba Inu continues to gain acceptance and recognition, it could see similar growth in its value. This potential for value appreciation could make it an attractive investment opportunity for those willing to take on the risks associated with cryptocurrency investing.

B. Challenges for Shiba Inu

Regulation and legal concerns

One of the biggest challenges facing Shiba Inu and other cryptocurrencies is regulation and legal concerns. Many governments and financial institutions are wary of cryptocurrencies, and there are concerns about their potential use in illegal activities such as money laundering and terrorism financing. As a result, there is a risk that governments could impose strict regulations or even ban the use of cryptocurrencies, which could significantly impact their value and adoption.

Competition from other cryptocurrencies

Another challenge facing Shiba Inu is competition from other cryptocurrencies. The cryptocurrency market is highly competitive, and there are hundreds of different currencies vying for market share. Shiba Inu will need to continue to differentiate itself from other currencies and establish its value proposition in order to remain competitive in the market.

WATCH THE VIDEO BELOW FOR MORE CLARIFICATION

Summary

A. Summary of Shiba Inu’s potential impact

Shiba Inu has made significant gains in the cryptocurrency market since its creation, and its recognition at the World Economic Forum signals a growing interest in the potential of cryptocurrencies in the broader economic landscape. As cryptocurrencies become more mainstream, they could have a significant impact on the global economy, and Shiba Inu has the potential to play a role in this shift.

B. Final thoughts on the World Economic Forum and Shiba Inu’s future

The World Economic Forum is an important platform for discussing and addressing global economic issues, and its recognition of Shiba Inu suggests that the role of cryptocurrencies in the global economy is being taken seriously. While Shiba Inu faces challenges in terms of regulation and competition, its unique branding and growing popularity suggest that it has the potential to be a significant player in the cryptocurrency market in the years to come.

(@eulerfinance)

(@eulerfinance)