Non-fungible tokens, or NFTs, have been making headlines in recent years as the art world has embraced digital assets as a new form of collectible art. Non-fungible tokens are a unique digital asset that is stored on a blockchain that can represent anything from digital artwork to virtual real estate.

With the increasing popularity of NFTs, it’s crucial for individuals and businesses to understand how to properly store and save NFT images to ensure their longevity and value. In this post, we will provide a comprehensive guide on how to save NFT images and keep them secure for years to come.

Understanding NFT Images

Before we dive into the steps for saving NFT images, it’s important to understand what an NFT image is and how it differs from traditional digital images. An NFT image is a unique digital asset that is stored on a blockchain and is verified as being one-of-a-kind. This means that an NFT image is not interchangeable or replaceable and has a set value that cannot be duplicated or altered.

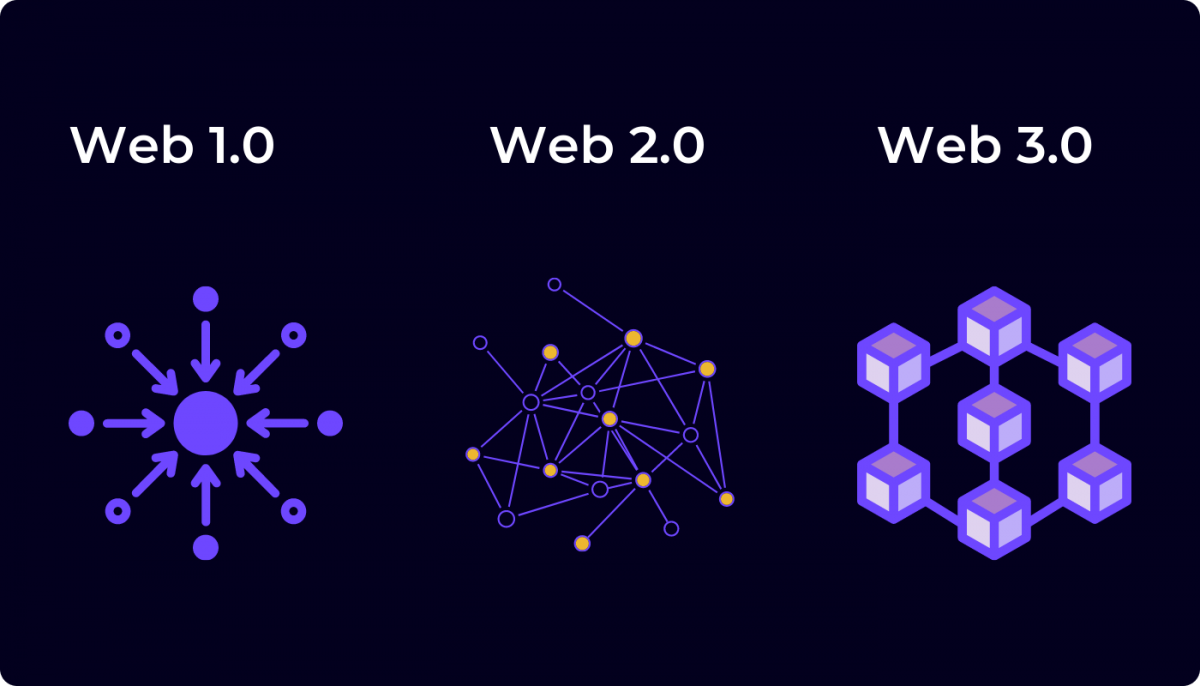

NFT photos, as opposed to standard digital images, are kept on a blockchain network. A blockchain network is a decentralized ledger that keeps a record of every transaction that occurs on the network. Because of this, NFT photos are significantly more secure than conventional digital images, as they cannot be deleted or changed without leaving a trail behind them. The ownership of NFT photos can also be readily transferred from one person to another using the blockchain’s decentralized ledger technology.

It’s important to note that NFT images are not stored on a physical server but are instead stored on the blockchain network. This means that the actual image file is stored on the computers of many different individuals who are part of the blockchain network. When someone wants to view an NFT image, the image is retrieved from the network and displayed on their device.

How to Save NFT Image?

- Choosing a Storage Platform

Once you understand the basics of NFT images, the next step is to choose a platform for storing your NFT images. There are several NFT storage platforms available, each with its own unique features and benefits. Some popular NFT storage platforms include OpenSea, SuperRare, and Nifty Gateway.

When choosing a platform, it’s essential to consider the following factors:

Security: To guarantee the integrity of your NFT photos, the platform you’re using absolutely must have stringent security protocols in place. Search for services that offer protection against hackers and theft by encrypting data and utilizing other secure storage methods.

Accessibility: The platform should be easy to use and accessible to anyone who wants to view or purchase your NFT images. This includes ensuring that the platform is compatible with a variety of devices and browsers.

Community: The platform should have an active community of users and creators who are passionate about NFTs and digital art. This can help to build exposure and increase the value of your NFT images.

Transaction Fees: Consider the transaction fees charged by the platform, as these can vary widely between platforms. Some platforms also charge a percentage of the sale price for each transaction, which can eat into your profits.

Customization: Look for platforms that allow for customization and branding, as this can help to create a unique and professional online presence for your NFT images.

Once you have considered the above factors, it’s time to compare the different NFT storage platforms and choose the one that is the best fit for your needs.

- Creating a Backup

One of the most essential steps in saving NFT images is creating a backup. A backup is a duplicate copy of your NFT image that you can use in case something happens to the original. There are several methods for creating a backup of your NFT images, including:

Local Backup: Performing this step requires you to save a copy of your NFT picture file to a local storage device, such as a hard disk or a flash drive. The creation of a backup using this approach is uncomplicated and uncomplicatedly straightforward, but it does have the disadvantage of being susceptible to physical harm or theft.

Cloud Backup: This is done by putting a copy of your NFT image file on a cloud storage service like Google Drive or Dropbox. This method is safer because the backup is kept off-site, but it costs more because you have to pay for a subscription to the cloud storage service every month.

Blockchain Backup: Some NFT storage platforms offer the option to create a back-up of your NFT image on the blockchain. This method provides the added security of being stored on a decentralized ledger, but it may also come with additional fees.

When creating a backup, it’s important to ensure it is stored securely. This can be achieved by using encryption, password protection, or other security measures to ensure that only you have access to the backup.

- Securing the NFT Image

In addition to creating a backup, there are other steps that can be taken to secure your NFT image and protect it from unauthorized access or theft. These include:

Encryption: Encrypting your NFT image file adds an extra layer of security, making it more difficult for unauthorized individuals to access the image. You can do this by using encryption software or the encryption features of your NFT storage platform.

Multiple Locations: Storing your NFT image in various locations can provide added security and reduce the risk of loss or theft. This can include storing a copy of the image file on a local storage device, as well as uploading a copy to a cloud storage service or the blockchain.

Password Protection: Adding a password to your NFT image file can provide added security and prevent unauthorized access. You can do this by using software that protects files with passwords or by using the password protection features of your NFT storage platform.

WATCH THE VIDEO BELOW FOR MORE CLARIFICATION

Benefits of Saving NFT Image

There are several benefits to saving NFT images, including:

Preservation of value: By properly saving NFT images, individuals and businesses can ensure that their unique digital assets are protected and preserved for years to come. This can help to maintain or increase the value of the NFT images over time.

Safe storage: By using a secure NFT storage platform, backing up NFT images, and implementing security measures, individuals and businesses can ensure that their NFT images are stored safely and securely. This helps to protect against loss or theft, which can result in significant financial loss.

Peace of mind: By properly saving and securing NFT images, individuals and businesses can have peace of mind knowing that their valuable digital assets are protected. This can help reduce the stress and anxiety associated with the loss or theft of valuable items.

Accessibility: By properly saving NFT images, individuals and businesses can ensure that their NFT images are easily accessible and retrievable. This can be especially beneficial for collectors and investors who want to quickly access and view their NFT images.

Display and sharing: Properly saved and secured NFT images can also be easily shared and displayed. This can help to increase the visibility and exposure of NFT images and can help to grow their popularity and value over time.

Summary.

Saving NFT images is an important step in preserving the value and longevity of these unique digital assets. By choosing a secure NFT storage platform, creating a backup, and implementing security measures, individuals and businesses can ensure that their NFT images are protected and preserved for years to come.

NFT images are a valuable and unique form of digital art that requires proper care and preservation. By considering the steps outlined in this article, you can ensure that your NFT images are stored securely and protected from loss or theft. Either you are an individual or a business, taking the time to properly save your NFT images is an investment in their future value and longevity.