Open Fortune FTX is a blockchain-based platform that offers a decentralized fortune-telling experience. This innovative platform leverages blockchain technology to offer users a secure, transparent, and immutable fortune-telling experience. In this article, we’ll dive deep into the features, benefits, and advantages of Open Fortune FTX, as well as its potential impact on the fortune-telling industry.

1. Open Fortune FTX

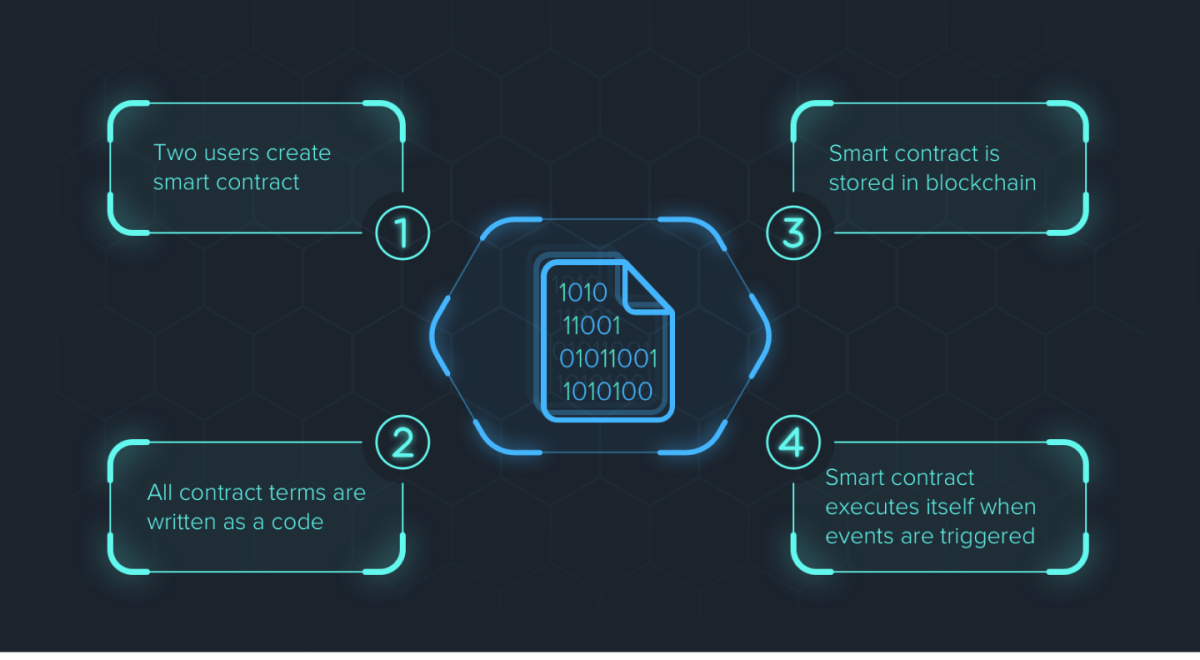

Fortune FTX is a decentralized platform that offers users a seamless and secure fortune-telling experience. This platform leverages the power of blockchain technology to offer users a tamper-proof and transparent fortune-telling experience. The platform is built on the Ethereum blockchain, and it uses smart contracts to execute transactions and verify results

1.1 Key Features and Benefits

Open Fortune FTX offers several key features and benefits, including:

1.1.1 Decentralized: Open Fortune FTX is a decentralized platform, which means that it is not controlled by a single entity or organization. This makes it more secure and transparent than traditional fortune-telling methods.

1.1.2 Secure: Fortune FTX leverages the power of blockchain technology to offer users a secure and tamper-proof fortune-telling experience. All transactions are recorded on the blockchain, which makes them immutable and transparent.

1.1.3 Transparent: Open Fortune FTX is a transparent platform, which means that users can see the results of their fortune-telling sessions on the blockchain. This makes it easy for users to verify the accuracy of their readings.

1.1.4 Efficient: Fortune FTX is an efficient platform that allows users to access their fortune-telling sessions quickly and easily. Users can access their sessions from anywhere in the world at any time.

1.2 Target Audience

Fortune FTX is targeted at anyone who is interested in getting a fortune-telling reading. This includes individuals who are looking for guidance, insight, or advice in various aspects of their lives, including relationships, careers, finance, and more. Open Fortune FTX is also ideal for those who are interested in exploring the world of blockchain technology and decentralized applications.

2. Market Analysis

The fortune-telling industry is a multi-billion-dollar industry that has been around for centuries. The industry has evolved over the years, and today, there are various types of fortune-telling methods, including tarot readings, astrology, palmistry, and more. However, the industry is still largely dominated by traditional fortune-telling methods, which are often perceived as unreliable and fraudulent.

2.1 Industry Overview

The fortune-telling industry is a highly fragmented industry that is largely dominated by small, independent practitioners. According to IBISWorld, the fortune-telling industry in the US is worth $2 billion and employs over 20,000 people. The industry has a low barrier to entry, which means that anyone can start a fortune-telling business with minimal investment.

2.2 Market Size and Trends

The fortune-telling industry is a growing industry that is expected to continue growing in the coming years. According to a report by Technavio, the global fortune-telling market is expected to grow at a CAGR of 2% from 2021 to 2025. The report cites the increasing interest in spirituality and the growing popularity of online fortune-telling services as key drivers of growth.

2.3 Competitors Analysis

Fortune FTX faces competition from various traditional and online fortune-telling services. Some of the major competitors in the industry include Kasamba, Psychic Source, Keen, and California Psychics. These platforms offer a range of fortune-telling services, including tarot readings, astrology, and psychic readings. However, these platforms often lack transparency and can be perceived as unreliable by some users.

2.4 Unique Selling Proposition

Open Fortune FTX’s unique selling proposition is its decentralized, secure, and transparent platform. The platform offers users a tamper-proof and immutable fortune-telling experience, which makes it more reliable and trustworthy than traditional fortune-telling methods. Additionally, Open Fortune FTX’s use of blockchain technology offers users a level of security and transparency that is unmatched by traditional fortune-telling methods.

3. Business Model

Open Fortune FTX’s business model is based on the following revenue streams:

3.1 Revenue Streams

Open Fortune FTX generates revenue through the following streams:

3.1.1 Fortune-Telling Fees: Open Fortune FTX charges users a fee for each fortune-telling session. The fee varies depending on the type of reading and the length of the session.

3.1.2 Subscription Fees: Open Fortune FTX also offers subscription packages that allow users to access multiple fortune-telling sessions at a discounted rate.

3.2 Pricing Strategy

Open Fortune FTX’s pricing strategy is based on the value that users receive from the platform. The platform charges a fair and competitive price for its services, which is based on the market demand and the cost of providing the services.

3.3 Sales and Distribution Channels

Open Fortune FTX uses a variety of sales and distribution channels to reach its target audience. These include:

3.3.1 Online Marketing: Open Fortune FTX uses various online marketing channels, including social media, search engine optimization, and content marketing, to attract and engage with its target audience.

3.3.2 Affiliate Marketing: Open Fortune FTX also partners with influencers and affiliates to promote its platform and attract new users.

3.3.3 Word of Mouth: Open Fortune FTX relies on word of mouth to promote its platform. The platform encourages users to share their experiences on social media and other platforms, which helps to attract new users.

3.4 Marketing and Promotion Strategy

Open Fortune FTX’s marketing and promotion strategy is focused on building brand awareness and driving user acquisition. The platform uses a variety of marketing tactics to achieve these goals, including:

3.4.1 Social Media: Open Fortune FTX uses social media to build brand awareness and engage with its target audience. The platform uses various social media channels, including Facebook, Twitter, and Instagram, to promote its platform and engage with its users.

3.4.2 Influencer Marketing: Open Fortune FTX partners with influencers and celebrities to promote its platform and attract new users. The platform uses influencer marketing to reach a wider audience and build credibility.

3.4.3 Content Marketing: Open Fortune FTX uses content marketing to educate its target audience about the benefits of blockchain technology and decentralized applications. The platform uses blog posts, videos, and other types of content to engage with its audience and build trust.

WATCH THE VIDEO BELOW FOR MORE CLARIFICATIONS.

4. Financial Projections

Open Fortune FTX’s financial projections are based on the following assumptions:

4.1 Revenue Projections

Open Fortune FTX expects to generate revenue of $10 million in its first year of operation. The platform expects to grow its revenue by 50% each year, reaching $75 million in revenue by its fifth year of operation.

4.2 Profit and Loss Projections

Open Fortune FTX expects to generate a net profit of $1 million in its first year of operation. The platform expects to achieve a net profit margin of 10% in its first year, growing to 15% by its fifth year of operation.

4.3 Cash Flow Projections

Open Fortune FTX expects to generate positive cash flow from its operations in its first year of operation. The platform expects to maintain positive cash flow throughout its growth phase, which will allow it to reinvest in the platform and continue to expand its services.

5. Risks and Challenges

Open Fortune FTX faces several risks and challenges that could impact its growth and success. These include:

5.1 Regulatory Risk: Open Fortune FTX operates in a regulatory grey area, which could impact its ability to operate and grow in the future. The platform may face regulatory challenges related to the use of blockchain technology and the provision of fortune-telling services.

5.2 Competition Risk: Open Fortune FTX faces competition from traditional fortune-telling methods and other blockchain-based fortune-telling platforms. The platform will need to differentiate itself and provide unique value to attract and retain users.

5.3 Technology Risk: Open Fortune FTX’s success depends on the reliability and security of its blockchain-based platform. The platform will need to invest in robust technology infrastructure to ensure that its platform is secure and scalable.

Summary

Open Fortune FTX is a blockchain-based fortune-telling platform that offers users a transparent, secure, and reliable fortune-telling experience. The platform’s use of blockchain technology provides users with a tamper-proof and immutable fortune-telling experience, which makes it more reliable than traditional fortune-telling methods. Open Fortune FTX’s business model is based on a variety of revenue streams, including fortune-telling fees and subscription fees.

The platform’s marketing and promotion strategy is focused on building brand awareness and driving user acquisition through social media, influencer marketing, and content marketing. While the platform faces several risks and challenges, its unique value proposition and focus on user experience make it a promising addition to the fortune-telling industry.