In today’s digital age, video streaming has become an integral part of our daily lives, revolutionizing the way we consume and share content. Traditional centralized video streaming platforms have long dominated the industry, but a new paradigm is emerging – decentralized video streaming platforms. In this article, we delve deep into the concept of decentralized video streaming platforms, exploring their characteristics, advantages, challenges, and potential impact on the future of online video streaming.

Characteristics of a Decentralized Video Streaming Platform

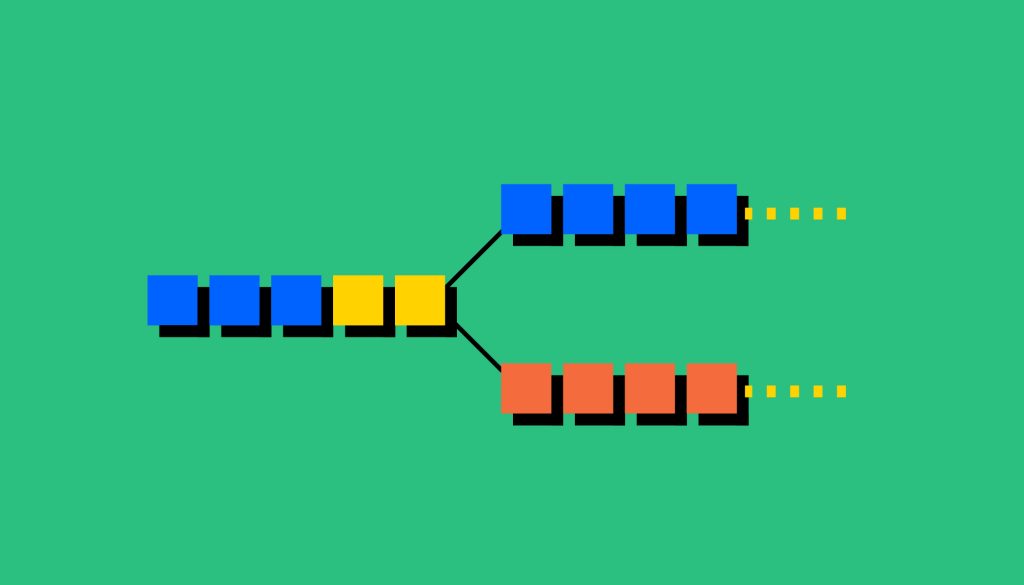

Peer-to-Peer (P2P) Architecture

A decentralized video streaming platform operates on a peer-to-peer (P2P) architecture, where participants in the network both consume and contribute content. Unlike traditional streaming platforms that rely on central servers, P2P architecture allows users to share video content directly with one another. This eliminates the need for a central authority and facilitates a more distributed and resilient network.

P2P architecture offers several advantages in video streaming. Firstly, it reduces the strain on central servers, allowing for efficient and scalable content distribution. Secondly, it improves video streaming performance by leveraging the resources of multiple peers, enabling faster and more reliable streaming experiences.

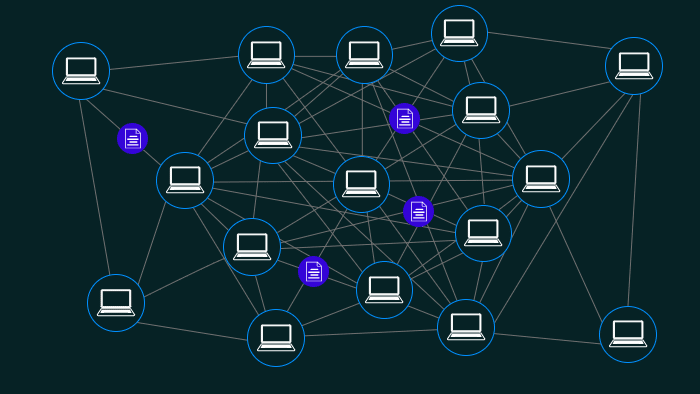

Distributed Network

Decentralized video streaming platforms are built on a distributed network, where multiple nodes or peers collaborate to deliver content. This network structure ensures that no single entity has complete control over the platform, making it more resistant to censorship, outages, and other forms of disruption.

By distributing content across multiple nodes, a decentralized network enhances reliability. Even if some nodes fail or become unreachable, the network can continue to function, ensuring uninterrupted video streaming for users. Additionally, distributed networks promote efficient bandwidth usage by leveraging available resources across the network, optimizing content delivery.

Blockchain Technology

Blockchain technology, synonymous with cryptocurrencies like Bitcoin, has found its way into decentralized video streaming platforms. By utilizing blockchain, these platforms introduce transparency, security, and immutability to the streaming process.

Blockchain acts as a decentralized ledger, recording and verifying transactions and interactions within the video streaming platform. It ensures content creators receive fair compensation, enhances copyright protection, and enables transparent revenue sharing models. Moreover, blockchain technology enhances content security by encrypting video data and providing a tamper-proof record of transactions and interactions.

Content Delivery Mechanisms

Decentralized video streaming platforms employ various mechanisms for content delivery. Some platforms utilize a hybrid approach, combining centralized and decentralized components, while others rely entirely on peer-to-peer networks.

Hybrid approaches involve leveraging central servers for initial content dissemination, while subsequent streaming occurs through peer-to-peer connections. This approach allows for efficient content distribution while maintaining the advantages of decentralized networks. On the other hand, fully decentralized platforms deliver content exclusively through peer-to-peer connections, ensuring high resilience, scalability, and user control over the streaming process.

Advantages of Decentralized Video Streaming Platforms

Increased Resilience and Reliability

Decentralized video streaming platforms offer increased resilience and reliability compared to their centralized counterparts. With a distributed network, these platforms eliminate single points of failure and reduce the risk of service outages. If a node becomes unavailable or experiences technical issues, other nodes in the network can compensate, ensuring uninterrupted video streaming.

The redundancy inherent in decentralized networks further enhances reliability. As content is distributed across multiple nodes, even if one or more nodes fail, the network can still deliver the video content, maintaining a smooth streaming experience for users.

Enhanced Privacy and Security

Privacy and security concerns are paramount in the digital era. Decentralized video streaming platforms address these concerns by providing enhanced privacy and security features. By leveraging blockchain technology, these platforms enable users to retain control over their personal data and viewing habits. Personal information is stored on the blockchain, ensuring transparency and allowing users to maintain anonymity if desired. This prevents centralized entities from accessing and exploiting user data for targeted advertising or other purposes.

Moreover, blockchain technology enhances content security by encrypting video data and providing an immutable record of transactions. This prevents unauthorized tampering with the content and ensures the integrity of the video streaming process. With decentralized platforms, users can have peace of mind knowing that their personal information is protected and their viewing experience is secure.

Cost-effectiveness and Scalability

Decentralized video streaming platforms offer cost-effectiveness and scalability advantages over centralized platforms. Traditional streaming platforms often require substantial infrastructure investments to handle increasing user demands. In contrast, decentralized platforms leverage the resources of the participants in the network, reducing the need for costly centralized infrastructure.

By utilizing peer-to-peer networks, decentralized platforms distribute the streaming load across multiple nodes, effectively scaling the network as the user base grows. This scalability ensures a seamless video streaming experience, even during peak usage periods. Additionally, the reduced reliance on centralized infrastructure results in lower operational costs, making decentralized platforms more economically viable in the long run.

Challenges and Considerations

While decentralized video streaming platforms bring numerous benefits, they also face certain challenges and considerations that need to be addressed for widespread adoption and success.

Network Scalability and Bandwidth

As decentralized platforms rely on peer-to-peer networks, ensuring network scalability and sufficient bandwidth can be a challenge. The performance of the platform depends on the willingness of users to contribute their resources, such as computing power and bandwidth, to the network. Incentivization mechanisms and effective resource management strategies are essential to encourage users to participate and contribute to the network’s scalability.

Efforts are being made to optimize the bandwidth requirements by employing advanced compression techniques and adaptive streaming algorithms. These techniques help deliver high-quality video content while minimizing the strain on network resources. Continued research and innovation in this area will further enhance the scalability and bandwidth efficiency of decentralized video streaming platforms.

Content Quality and Consistency

Maintaining consistent content quality across a decentralized network can be a challenge. In a peer-to-peer environment, the quality of video streaming relies on the resources and capabilities of individual peers. This variability in resources can lead to inconsistencies in video quality, buffering issues, and latency.

To address this challenge, decentralized platforms employ various mechanisms such as content caching, content replication, and adaptive streaming algorithms. These techniques aim to optimize the delivery of video content by dynamically adjusting video quality based on the viewer’s network conditions. By utilizing these strategies, decentralized platforms can provide a consistent and high-quality streaming experience to users.

Governance and Content Moderation

Decentralized video streaming platforms face governance and content moderation challenges, as there is no central authority to enforce rules or guidelines. Ensuring appropriate content moderation, preventing piracy, and addressing copyright infringement require robust governance mechanisms.

Community-driven governance models, where participants collectively make decisions regarding content policies and moderation, can be implemented. This ensures that the platform aligns with the values and expectations of its users. Additionally, advanced content identification technologies, such as fingerprinting and watermarking, can be employed to detect and prevent unauthorized distribution of copyrighted material.

User Adoption and Incentivization

Encouraging user adoption and active participation in a decentralized video streaming platform is crucial for its success. Users need to be incentivized to contribute their resources and share their content. Incentive models, such as tokenization and rewards systems, can motivate users to actively participate in the network by providing them with tangible benefits for their contributions.

Building user-friendly interfaces and seamless user experiences are also vital for attracting and retaining users. Simplifying the onboarding process, improving content discovery mechanisms, and ensuring smooth streaming experiences will contribute to increased user adoption and engagement.

WATCH VIDEO BELOW

Examples of Decentralized Video Streaming Platforms

Several decentralized video streaming platforms have emerged, showcasing the potential of this technology. Let’s explore two notable examples:

IPFS (InterPlanetary File System)

IPFS is a widely recognized decentralized file system that can also be used for video streaming. It utilizes a distributed network of nodes to store and share files across the network. IPFS employs content addressing, where each piece of content is uniquely identified by its cryptographic hash, ensuring content integrity and easy retrieval.

In the context of video streaming, IPFS allows users to share and stream video content directly from their devices, reducing reliance on centralized servers. As content is distributed across the network, the platform benefits from increased resilience and faster content delivery. Additionally, IPFS supports offline content availability, enabling users to access previously streamed videos even without an internet connection.

Livepeer

Livepeer focuses on decentralized live video streaming. It leverages blockchain technology and a network of nodes to facilitate live video transcoding and distribution. Livepeer enables content creators to stream live video content with high quality and low latency by utilizing the computing power of the network participants.

Through the Livepeer network, video content is encoded, transcoded, and distributed across multiple nodes, ensuring efficient content delivery and scalability. The platform employs a tokenized ecosystem, where participants can earn rewards by contributing their computing resources to the network. This incentivization model encourages users to actively participate in the network, resulting in a robust and reliable live streaming experience.

Future Prospects and Potential Impact

The rise of decentralized video streaming platforms has the potential to revolutionize the way we watch and share content online. As these platforms continue to evolve and overcome challenges, they could disrupt the dominance of traditional centralized streaming platforms. The benefits of increased resilience, enhanced privacy, cost-effectiveness, and scalability position decentralized platforms as a compelling alternative.

Decentralized video streaming platforms also open doors to new possibilities beyond traditional content delivery. The combination of blockchain technology and peer-to-peer networks can enable innovative monetization models, content licensing, and transparent revenue sharing. Moreover, the decentralized nature of these platforms fosters a more inclusive and diverse content ecosystem, empowering content creators and viewers alike.

Summary

Decentralized video streaming platforms present an exciting paradigm shift in the world of online video streaming. By leveraging peer-to-peer networks, blockchain technology, and distributed architectures, these platforms offer increased resilience, enhanced privacy, cost-effectiveness, and scalability.

While challenges such as network scalability, content quality, governance, and user adoption need to be addressed, the potential impact of decentralized video streaming platforms is significant. As these platforms continue to mature and gain traction, they have the potential to disrupt traditional streaming models, empower content creators, and provide viewers with a more immersive, secure, and personalized streaming experience.

The future of video streaming lies in the hands of decentralization, where the power is distributed among the users themselves, creating a truly democratized and inclusive streaming ecosystem.