The blockchain society strongly believes in decentralization and peer-to-peer transactions. In fact, Satoshi Nakamoto described bitcoin as a decentralized, peer-to-peer (p2p) virtual monetary system. In spite of this, the great majority of crypto trading and purchases still occur on centralized exchanges, with market makers or brokers on the opposite side of the transaction.

So, What is P2P Crypto Trading?

The term “peer-to-peer trading” (P2P) is used to describe the buying and selling of cryptocurrencies between users on decentralized exchange marketplaces. In contrast to centralized exchanges, your money are never in the hands of a third party when you trade using this technique.

To complete a transaction, pending orders from other users are compared to the order you placed. Once confirmed, transactions are processed instantaneously and you pay a fraction of the fees paid by traditional exchanges due to the decentralized nature of the network. The P2P business model gained traction with the introduction of blockchain technology.

Understanding P2P Crypto Trading

File-sharing systems, such as the music-sharing program Napster, which was first released in 1999, are largely credited for popularizing the current peer-to-peer idea.

The peer-to-peer concept made it possible for millions of people who use the internet to directly connect with one another, to organize themselves into groups, and to work together so that they might serve as user-created search engines, virtual supercomputers, and file systems.

The client-server model of network organization is distinct from this form of network arrangement because, in the client-server model, communication is often directed to and from a centralized server.

How It Works

Let’s utilize a commonplace online marketplace to highlight the key distinction between P2P trade and dealing directly with a cryptocurrency exchange. Online retailers like Amazon and Jumia allow customers to peruse extensive product catalogs in search of the lowest possible price. You may avoid dealing with the product’s real vendor by paying Amazon or Jumia instead.

You receive your merchandise and the seller gets their money without ever having to talk to each other directly. Typically, a cryptocurrency exchange operates like this. By acting as a neutral third party, the cryptocurrency exchange conceals neither the identities of the buyer nor the seller.

The procedure is substantially different when using online marketplaces like eBay or Jiji. You may shop on the site by looking through a catalog of items and seeing information about the vendors right there.

You may contact the seller to negotiate a lower price, or you may finish the purchase entirely online, with payment sent straight to the seller’s account and delivery handled without any involvement on your part. In many ways, this is not unlike to a p2p system. The only real distinction is that you are exchanging fiat currency for cryptocurrency instead of actual goods.

Taking part in a peer-to-peer transaction indicates that you are familiar with the individual or organization with whom you are dealing, including their name, the address of their cryptocurrency wallet, the details of their bank account, their IP address, their location, and in certain instances, the possibility of meeting in person.

Pros and Cons

Pros

You will find a list of both the benefits and drawbacks of P2P trading below for your consideration:

Zero trading costs: Some P2P trading platforms do not charge any commission or transaction fees, in contrast to the typically low trading fees charged by centralized cryptocurrency exchanges, which range from 0.1 to 0.3 percent. However, it’s possible that you’ll end up paying a lot in gas and network costs for the on-chain transactions.

Reputation systems: P2P trading platforms have included reputation systems with reviews in order to have a better notion of the trustworthiness of a buyer and seller. Before moving forward with the transaction, both buyers and sellers have the ability to read the feedback left for their possible new business partner.

Payment options: Users of P2P trading may benefit from additional or more flexible methods of payment. This is compared to users of centralized exchanges, which are typically limited to SEPA. And also credit card, or PayPal as payment options. This is due to the fact that it is up to the preferences of the individual users of the platform.

Escrow assistance: The need to trust the other party is obviously much stronger with P2P trading. It is often an involved escrow service that enables users to begin transfers in a comfortable manner. This is because money is only released if the other party has completed its portion of the deal. However, the author feels obligated to mention that not all peer-to-peer trading platforms provide escrow services. Furthermore, the ones that do often demand payment in return for the service.

Cons

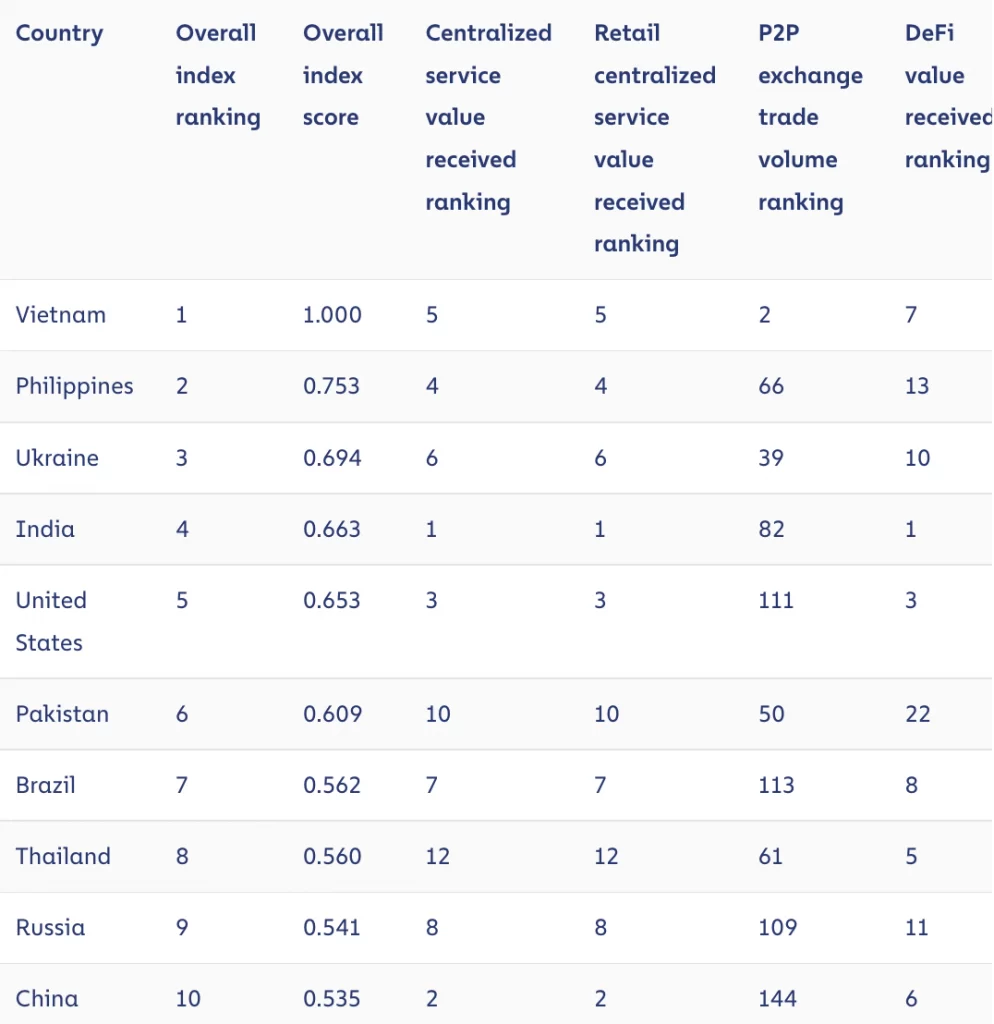

- It’s possible that less popular P2P trading platforms may sometimes have insufficient liquidity. Illiquid markets increase the time it takes to execute a deal. Low liquidity affects currency prices. The use of P2P markets reduces this problem.

- P2P trading completes fast as long as both parties agree on conditions in advance. If one of the parties involved in the transaction does not confirm or agree to the conditions. The procedure then slows down.

- One main drawback of P2P trading is the possibility of falling victim to fraudsters and losing money. That’s why it’s crucial to constantly utilize reliable trading techniques and validate all transactions. When exchanges necessitate the use of third-party platforms, traders increase their risk of falling victim to fraud. Therefore, before agreeing to agreements, you should make sure the other merchant has fulfilled all conditions. Don’t act hastily while doing P2P transactions.

Closing Thoughts

P2P (peer-to-peer) crypto trading eliminates the need for a centralized authority to set pricing. It is believed by many to make it potentially more lucrative than conventional exchanges. Because of this, peer-to-peer markets may often provide improved exchange rates in addition to lesser costs. This can assist you in optimizing the amount of profit you make while trading cryptocurrencies.