What will happen to US$49 million worth of donations? This is the question now that the world’s most ambitious and recent cryptocurrency experiments are done. What will be done with the monies raised and other important questions remain unanswered.

Sotheby’s auction house hosted a peculiar bidder on Thursday night. The bidder was ConstitutionDAO. ConstitutionDAO is an ad-hoc group. It has an excess of 17,000 donors. These donors collectively contributed towards purchasing a rare print of the Constitution of the United States of America.

About the Bidding

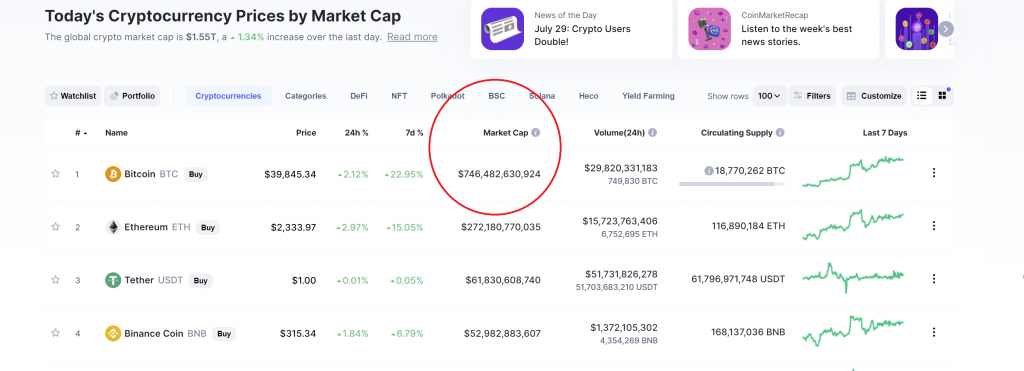

The bidding concluded at $43.2 million. This was less than the $49.5 million that the DAO managed to raise. This amount estimated, and connected to the costs of logistics, storage, insurance, and auction fees, among other overheads prevented the DAO from making a higher bid. A DAO (decentralized autonomous organization) is a gathering of people on the internet that use various tools to exercise governance decisions in various arenas.

On Friday, Wall Street Journal reported that the Billionaire, Ken Griffin, known for his hedge fund management, outmatched the group. Numerous observers applauded the attempt by the DAO’s however, because of the extraordinary effectiveness that DAOs displayed as a coordination resource. The whole project was birthed and executed in under 7 days in what members considered a company in “hyper-growth”.

Yossi Hasson, the CEO of Metaversal said in an interview with CoinDesk that many of the people involved were strangers on Thursday but managed to work together on a single goal of purchasing a copy of the US institution. Hasson contributed the most with 1,000 ETH ($4.2 million).

Questions and Opportunities

Lessons have been learned even if this grand ambition did not bear the intended fruit. However, there are more questions than could have been anticipated. Who gets to keep the money that was raised? What happens now to the DAO tokens for this failed project? Is this the first case of some sort of crowdfunding movement in the market place? It certainly sounds like something the world could benefit from considering all the worthwhile causes that exist out there that are underfinanced and need support.

What will happen to the Artifact?

Initially, the Citadel founder said he did not know how to think about crypto like bitcoin and thus never did. However, later in the year when prices of bitcoin blew up, he called crypto a “jihadist call” against the United States Dollar. Now, the billionaire hedge fund manager, Ken Griffin has purchased this artifact and will reportedly donate this document to a museum.

How were funds raised?

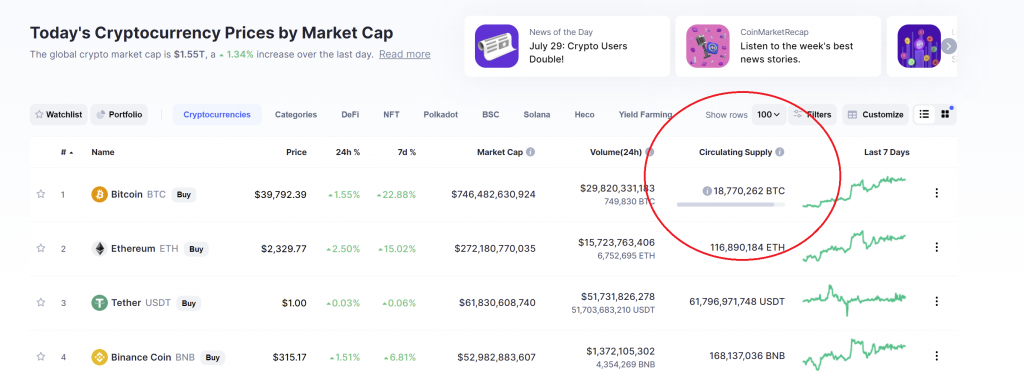

DAO raised these funds over a tool called Juicebox. Juicebox is an Ethereum-based community fundraising tool. When members of the DAO donated with ETH, they received in exchange PEOPLE. PEOPLE is an ERC-20 token that would have given owners the access rights to ConstitutionDAO. ConstitutionDAO would have been managed by an LLC. The LLC would have owned the document. There has been speculation on the price of PEOPLE possibly gaining value on an auction win. It did immediately after donations were closed for a brief period. However, the token has now crashed once news broke that the DAO lost the auction.

How Will the funds be returned?

What will happen now, you may be wondering. That’s a good question, especially since this is a whopping US$43.2 million and change. The good news for those that submitted their donations is that they can claim their funds (excluding fuel fees). The official Discord provided information on the return’s process but more information is to be released. We do not know if users will look at exchanging PEOPLE for ETH. We also do not know if donating addresses will be able to get refunded the monies they added.