Crypto is a disruptive force that is giving the traditional financial system a run for its money. With the rapid growth in the industry, however, comes concern about the future of cryptocurrency.

To determine the future of crypto assets, it is crucial that we take a look at the current state of the market, the different opportunities available, and the total value of the industry.

What is a better way to predict the future than to study history? Let’s go back to where it all started.

A Brief History of Cryptocurrency

Many people think that the concept of cryptocurrencies started a little over a decade ago, with the launch of the first well-known cryptocurrency, Bitcoin.

However, the history of cryptocurrencies dates back to the late 1900s. Around the year 1983, David Chaum, an American computer scientist and cryptography pioneer, invented the concept of digital coins.

It was not until nine years later, around 1990, that the term “cryptocurrency” became used for the idea of creating digital coins.

Chaum’s first digital currency was the eCash, which was closely followed by the launch of another coin that worked with the same principles as the first, DigiCash.

However, one thing that stood out in Chaum’s second invention was the principles guiding the way that transactions were carried out using DigiCash.

Chaum developed the system in such a way that every transaction remains completely anonymous even though they were done on a public network, and that has remained a constant in subsequent cryptocurrency projects.

Chaum’s invention of the digital currency phenomenon established several crucial frameworks for many other developers who took up the idea and developed it into what we know it as today.

Fast forward to 2008, an entity under the pseudonym, Satoshi Nakamoto, published a widely-circulated whitepaper that highlighted several benefits of peer-to-peer electronic cash.

Just a few months after the release of the whitepaper, the king of modern-day cryptocurrencies, Bitcoin, was launched alongside a revolutionary technology that seeks to revolutionize the existing economic systems of the world, Blockchain technology.

It has been more than 10 years since bitcoin came into existence and for the past few years, cryptocurrencies have become a widespread notion.

Let’s see what has now become of the emerging industry.

The Current State of Cryptocurrencies

As mentioned earlier, the cryptocurrency market is made up of many projects. Let’s look at the various sectors that make up the industry.

Bitcoin

Since bitcoin was the first cryptocurrency to be launched, it has maintained its position at the top of this rapidly growing industry, even after being in existence for more than 10 years.

The idea behind Bitcoin is to allow the secure and anonymous transfer of online payments between two parties without any need for an intermediary.

Bitcoin has managed to grow a global community of enthusiasts and spurred the emergence of a rapidly growing industry with millions of users and developers creating several new crypto projects.

The launch of the king coin has inspired developers to create various competing projects that have brought the entire crypto industry to a valuation of more than $2 trillion in just a little over a decade.

Bitcoin currently sits on top of the crypto market with a market cap of $1.1 trillion, which is almost half of the entire industry’s market cap.

The king of cryptocurrencies had gone from having little to no value in 2009 and the few years after its launch to becoming a trillion-dollar asset class.

Its price recently hit a new all-time high (ATH) of $66,229 earlier on October 20, 2021, and has witnessed the influx of large institutional investors over the past few years.

Additionally, thousands of crypto platforms are emerging every day and these are providing countless use cases for bitcoin and driving its adoption.

More recently, though, several world governments are starting to realize the benefits attached to legalizing the use of bitcoin in their countries.

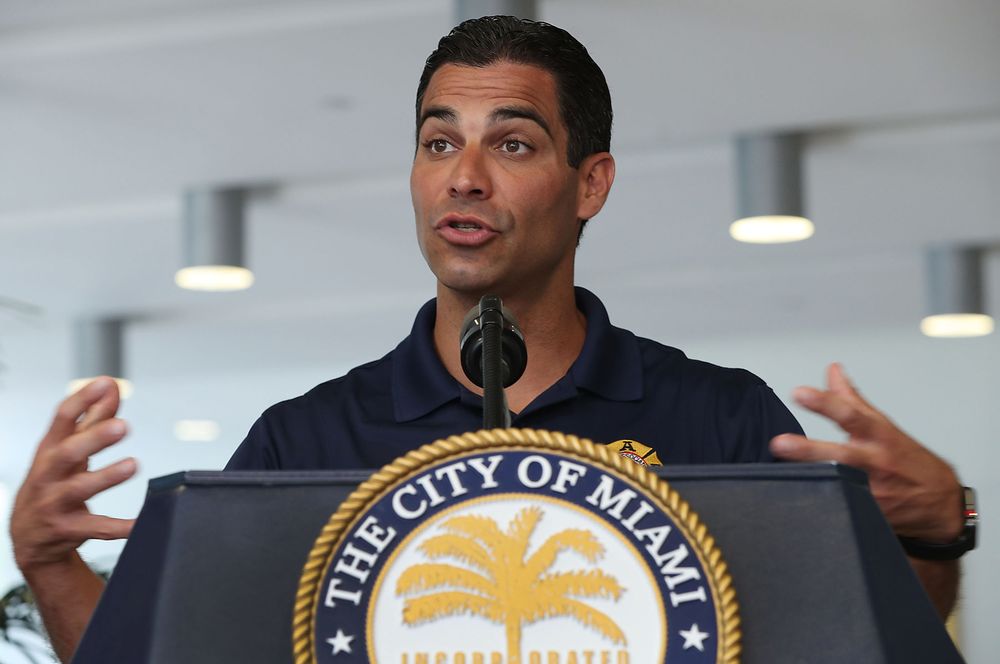

El Salvador went into the pages of history as the first country to adopt bitcoin as a legal tender, mine it with volcanoes, airdrop it to citizens, and build a pet hospital with its BTC gains, among other things.

Bitcoin has maintained its dominance in the market for a long time, although it is gradually losing it, it still has a strong presence in the crypto industry and that is not going away anytime soon as it is believed to be the future of crypto.

Altcoins

Shortly after Bitcoin gained global attention as the first successful cryptocurrency project, several developers went to work, trying to create something that would prove to be better than Bitcoin and that was how the concept of altcoins was born.

The term itself is coined from two words, “alternative” and “coin,” which in this case represents cryptocurrency.

That said, altcoins refers to all cryptocurrencies other than Bitcoin. Since Bitcoin and these alternative coins share a similar framework, some of the principles guiding their operations are similar, including mining processes, peer-to-peer models, and more.

Altcoins in general try to project themselves as better alternatives to Bitcoin, targeting some perceived drawbacks in Bitcoin’s design and coming up with solutions to those weaknesses.

Most of them aspire to become the “next bitcoin” by offering numerous features that might appeal to users and becoming a go-to option for crypto enthusiasts.

But despite having all these similarities, altcoins differ from one another. There are more than 13,000 alternative coins in the crypto market today, with new ones being launched almost every day.

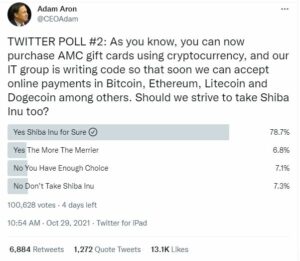

Some popular altcoins include Ethereum, Litecoin, Cardano, Solana, Polkadot, XRP, Monero, and even the meme-inspired cryptocurrency, Dogecoin.

Let’s take a look at one of the most popular altcoins.

Ethereum is one of the most successful ICOs of all time. After raising $5.2 million in 2015, the project has become the network behind the second-largest cryptocurrency in the world, with a market cap of $491.21 billion.

The project was created to enable developers to build smart contracts and decentralized apps (dApps) that can be used without any risk of downtime or interference from a third party, features that are lacking in Bitcoin’s protocol.

Although it has its limitations, Ethereum is the largest smart contract network in the industry and has set the pace for several smart contract protocols.

Altcoins are progressively taking a chunk of the crypto market, offering numerous opportunities for growth and holders to generate income.

It also features thousands of interesting projects that are taking the crypto industry to mainstream users.

Stablecoins

Despite being altcoins, Stablecoins have a unique feature that sets them apart from other crypto coins in the industry.

As the name suggests, they are designed to maintain a fairly stable value amid the extreme volatility experienced in the cryptocurrency market.

Stablecoins have their values pegged to an underlying asset to maintain a stable value.

Many of the biggest stablecoins in the market have their values pegged to the US dollar, which in effect mimics the value of the dollar.

The stability of these dollar-pegged stablecoins is maintained by keeping a sum of cash, treasury bills, commercial papers, and other government documents that is equal in USD to the number of coins in circulation.

Some of the top stablecoins include Tether, USD Coin, Binance Coin, etc.

Let’s now look at the top stablecoins in the market.

USDT is a stablecoin issued by the Hong Kong-based company, Tether, whose value is pegged to the price of the US dollar.

It is currently the top stablecoin in the market and the fifth-largest cryptocurrency in the world, with a market cap of $69.62 billion.

Stablecoins have received a lot of attention from people who are skeptical of venturing into the highly speculative crypto market but do not want to be left out.

It offers a bridge between the crypto industry and the traditional financial system.

Decentralized Finance (DeFi)

The term “DeFi” is currently a household name within the cryptocurrency industry. It is making several headlines and receiving global recognition in all sectors of the world’s economy.

DeFi is short for decentralized finance and it refers to a wide range of blockchain-based financial services that operate independently of centralized financial intermediaries like banks, brokerage firms, exchanges, and more.

These decentralized applications (dApps) are built with smart contracts and they allow investors to actively manage and grow their investments via various methods, including decentralized borrowing and lending, speculating on the price movements of a wide array of assets using derivatives, earning yield via staking, and many more.

The DeFi space has grown so much within the last couple of years that its value has skyrocketed. There is currently about $247.03 billion total value locked (TVL) in DeFi apps, according to the DeFi tracking platform, DeFi Llama.

Some of the top DeFi tokens include LUNA, UNI, AVAX, LINK, WBTC, DAI, and more.

Non-Fungible Tokens (NFTs)

This is currently one of the hottest aspects of the crypto industry and it is expanding even beyond the crypto space.

Non-fungible tokens, or NFTs for short, are digital representations of any item including collectibles, pieces of art, in-game assets, sports cards, and many more.

These tokens refer to the registration of ownership of a particular digital art on the decentralized ledger network — blockchain technology.

NFTs are unique digital assets, with each token containing distinguishing information that makes it both different from other similar NFTs yet easily verifiable on the blockchain.

In recent years, almost everything is becoming an NFT, music videos, rare sports moments, trading cards, artworks, cats, frogs, tweets, and as absurd as it may sound, even stone.

The scarcity and degree of uniqueness of these tokens increase the demand for them by avid digital art collectors and investors who are often more than willing to outrageous sums of money to purchase them.

Speaking of outrageous, the most expensive NFT sold to date, a piece of digital art created by American artist Mike Winkelmann, popularly known as Beeple, was auctioned off for a whopping $63.9 million.

About three years ago, the concept of non-fungible tokens was not as popular as it is today. This aspect of the crypto market has gradually grown into a $370 billion industry.

There are currently several NFT marketplaces where NFT transactions are carried out. Some of the biggest NFT marketplaces include OpenSea, Rarible, SuperRare, and others. These platforms manage millions of transactions daily.

The popularity of NFTs has also led to the rise of NFT-based games and the play-to-earn business model, where gamers earn crypto tokens while playing their favorite games.

These games have become so popular that they are now a source of income for people in most countries with high levels of unemployment, including the Philippines.

Some popular NFT projects include Axie Infinity, CryptoKitties, Decentraland, NBA Top Shot, Sorare, Gods Unchained, and more.

Having considered the current state of the crypto industry, what will become of this fast-evolving trillion-dollar industry in the next five years and beyond? Let’s find out.

What Will Be the Future of Cryptocurrency in Five Years and Beyond?

The cryptocurrency industry and the groundbreaking technology upon which it is built, Blockchain technology, is rapidly revolutionizing the traditional financial systems.

Many crypto critics strongly argue that cryptocurrencies are a massive bubble that will soon burst, leading to the collapse of the industry.

There have been several debates around its lack of clear regulation, its use in finding criminal groups and terrorism, and the environmental impact of crypto mining.

Crypto enthusiasts, on the other hand, strongly believe in the green future of cryptocurrency. They are convinced that cryptocurrencies are the only solution to the money printing disease plaguing central banks across the globe.

The emergence of several use cases of crypto further cements the confidence that crypto enthusiasts have in the asset class.

In all these chaotic and conflicting opinions, one thing is clear — the success story of the crypto industry cannot be undermined. It has gone from a little-known internet concept to a massive trillion-dollar industry that is disrupting global economies.

We are still in the early stages of the crypto revolution and there is still a long way off until it reaches its full potential. With the increased influx of large institutional investors into the crypto space, the industry is moving toward a mainstream adoption stage.

Financial regulators all over the world are scrambling to create clear regulations that will guide the use of crypto assets in various countries.

Central banks in various countries are considering issuing a digital version of their fiat currencies, which will be built using blockchain technology.

True, opposition remains, as several countries, including China, are kicking against the use of crypto and all crypto-related activity by its citizens.

However, a greater portion of the world’s population is adopting cryptocurrencies and their use in solving several global financial issues, including cross-border payments, cannot be overemphasized.

The industry remains a highly speculative and volatile market, but the history of its price movements is evident that the future of crypto is very green.