Coinposters

Bitcoin price returns to ‘critical’ pivot zone as $33K stays untouched.

Bulls are having problems reclaiming lost support levels, but $30,000 remains a solid foundation in Bitcoin’s trading range.

A sharp rebound overnight propelled the pair to highs of $32,970 after briefly reaching $31,750 overnight. The $33,000, which had previously been a sure source of support, was now out of reach.

Bitcoin price: It is reasonable and starts at less than USD 33,000.

Bitcoin/USD traded in a range on Wednesday, according to data from Bitcoin Markets Pro and Trading View. However, volatility increased slightly.

A sharp rebound overnight propelled the pair to highs of $32,970 after briefly reaching $31,750 overnight. The $33,000, which had previously been a sure source of support, was now out of reach.

According to well-known trader Michael van de Poppe, Bitcoin needed to break out of this zone between $32,600 and $38,000 to have a chance of reaching high-level targets in its trading range.

“Many alternative cryptocurrencies are conducting double bottom tests. This is fantastic, thank you! ,”According to his most recent Twitter update, he also said

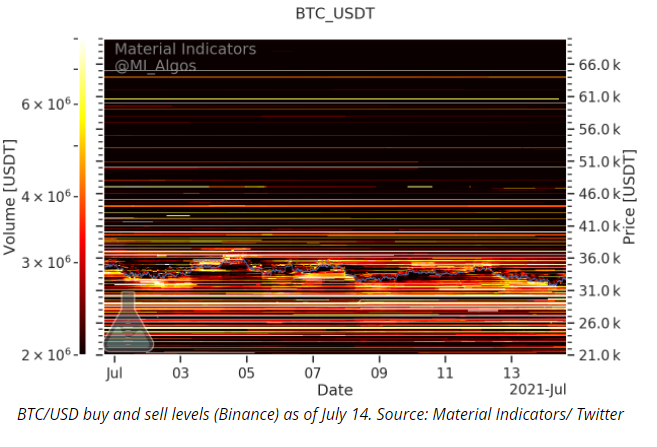

With repeated attempts to break the $33,000 barrier, Bitcoin was trading around $32,800 at writing. With support holding firm at $30,000, buy and sell levels on Binance showed a resistance band at $33,000, which was gradually dissipating.

Powerful hands quietly scoop up large amounts of liquidity

A much-publicized “Bitcoin bill” would have be presented to the government of Paraguay on this day, and expectations were high among the public. As of now, there is little information about the legislation; however, some believe the country will seek to emulate the example set by El Salvador and make Bitcoin legal tender.

There was little else for bulls to leverage when writing, aside from network fundamentals, with accumulation by investors of all sizes still to manifest itself in price movement.

Referred to as Excellent purchase Currently, Bitcoin is trading at a record low of 59 per cent below the target price of the BTC stock-to-flow model.

After conducting new research, William Clemente hypothesized that there might be a “lag” in the response of prices.

“Alternately, put: A lag between prices and accumulation flows can occur from time to time. If we had a bull dive in January or September 2020, it would be about half the size of the one we had in January or September 2019 “His remarks were made through social media commen.

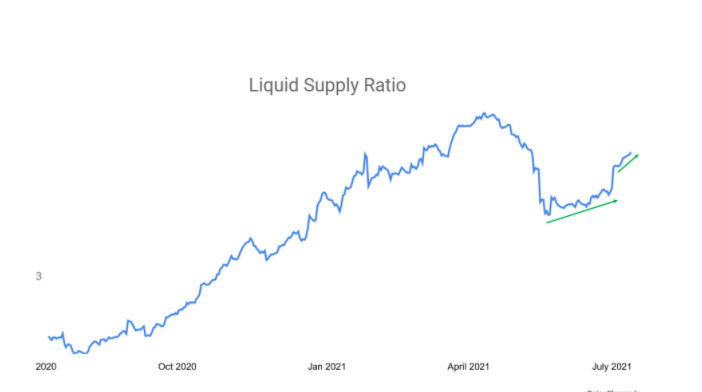

Bitcoin liquid supply ratio annotated chart. Source: William Clemente/ Twitter

We had one in March 2020, but macro forces can override this,” says the author.

Clemente displayed a chart of Bitcoin’s liquid supply ratio (LSR), a metric that is now signalling the movement of BTC to those who have had little experience selling the cryptocurrency.

Referring to the halving of block subsidies that took place last year. “Nothing has changed, supply shock is still in play,” he said of the supply shock.

Bitcoin liquid supply ratio annotated chart. Source: William Clemente/ Twitter.

“It is showed by LSR that the action of Bitcoins being reabsorbed by powerful hands only continues to diverge more from the price of Bitcoin. Also down -21,829 BTC on exchanges in the last two weeks, with a clear accumulation trend in those flows as well.”

Trading in cryptocurrency occurs in other markets as well.

According to the Investing.com Index Ethereum was the last trading at $2,124.66, a 14.54 percent decrease over the day.

On the Investing.com Index Bi-nance Coin was trading at $478.50, representing a loss of 10.36 per cent compared to the previous trading day.

Ethereum’s market capitalization was $253.4 billion at the time of writing, accounting for 12.02 per cent of the total cryptocurrency market capitalization, while Binance Coin’s market capitalization was $75.4 billion, accounting for 3.58 per cent of the total cryptocurrency market capitalization at the time of writing.

What are bitcoin prices and bitcoin?

Bitcoin is the world’s first decentralized cryptocurrency – a type of digital asset that uses public-key cryptography to record, sign, and send transactions over the Blockchain network – and it is also the most valuable cryptocurrency in the world.

The Bitcoin network (with an uppercase “B”), which was founded on January 3, 2009, by an anonymized computer programmer (or group of programmers) using the pseudonym “Satoshi Nakamoto,” is a peer-to-peer electronic payment system that makes use of a native cryptocurrency called bitcoin (lower case “b”) to transfer value over the internet or act as a store of value, similar to gold and silver. Bitcoin is a digital asset that can make payments and store.

Because each bitcoin comprises 100,000,000 Satoshi (the smallest unit of Bitcoin), each bitcoin is divisible by up to eight decimal places. This enables consumers to purchase fragments of a bitcoin for as little as one Usd per unit of bitcoin.

At $30,000, Bitcoin (BTC) is experiencing a “reset” in investor behaviour, and if the trend continues, the price of the cryptocurrency will rise.

According to econometric, if holders continue to accumulate bitcoins and dollars, the only way to go for the cryptocurrency is “up,” according to econometric, an on-chain monitoring resource on Tuesday.

“Interesting” data points to a resurgence in demand.

Econometric discovered that a significant shift has occurred in buying coins ever since the start of the latest bull market in October 2020 compared to the previous year.

Smaller investors, also known as “small fish,” were the ones who were accumulating wealth at the outset. Initially, this occurred when Bitcoin surpassed its previous all-time high of $20,000, and it has continued up to the new all-time high of $6

“According to Econometrics, $30k is a critical level that has halted the trend of a coin accumulation by whales,” the company stated.

One possible explanation for why selling pressure eventually took hold is that whales believed Bitcoin was gaining “too much, too soon,” and that the market, as a result, had become unsustainable.

Latest

Bitcoin

09 May 2024

Bitcoin

19 Apr 2024

Bitcoin

16 Jan 2024

Bitcoin

31 Aug 2023

Bitcoin

24 Jun 2023

Bitcoin

24 Jun 2023