Worldcoin (WLD) is currently poised to confirm a bullish reversal pattern, though broader market trends have introduced some delays in this trajectory. With strong backing from its investors, the digital currency has the potential to extend its upward movement, assuming it maintains above critical support levels.

The token is greatly boosted by its all star founding team but is there more to it? We dive in to find out. Is it a good time to invest? Is it a token worth your beloved USDT? Let’s find out!

Investor Confidence in Worldcoin Persists

Recently, Worldcoin has experienced some price adjustments following a period of market stabilization. During this time, the cryptocurrency was on the verge of cementing a bullish reversal trend, which appears set to resume.

Despite recent price dips, WLD holders have shown a positive outlook. Particularly notable is the activity of large-scale investors or “whales” who have not only continued to accumulate WLD but have also increased their acquisition rate. Over just one week, whale addresses holding between 100,000 and 1 million WLD increased their stakes by over 2 million WLD, amounting to an investment of approximately $11.6 million. This significant purchase indicates strong investor confidence and preparation for potential price increases.

Additionally, there has been a noticeable uptick in engagement from both retail and whale investors. The increase in transaction volumes on the blockchain, coupled with the rising WLD price, is often interpreted as a bullish indicator.

WLD Price Forecast: Completion of a 22% Increase Anticipated

At the moment of analysis, WLD/USDT is trading at $5.8 on Gate.io, having recently surpassed the critical point in a double-bottom pattern—a formation that suggests a potential shift from a downward to an upward trend.

This pattern typically appears when a stock’s price hits a low, recovers slightly, tests the same low again, and rebounds, signaling a potential shift in market sentiment.

With these factors in mind, the anticipated 22% growth in WLD’s price seems achievable and WLD price prediction models support it. Despite the recent market correction, it is expected that WLD will recover from its current support level of $5.6, potentially reaching up to $6.8.

Conversely, if the price falls below the $5.6 support level, the cryptocurrency might retreat to $5.0. A further drop below this secondary support level would challenge the bullish forecast, potentially leading to a decrease to $4.3.

WLD Under Microscope

Worldcoin is a unique digital currency initiative aimed at global adoption by combining cryptocurrency technology with a novel approach to identity verification. Unlike typical cryptocurrencies, Worldcoin’s vision involves a biometrically-linked system designed to ensure one account per human through the use of proprietary hardware called the “Orb.” This model seeks to address issues of identity and security, which are often challenges in the broader crypto space.

Background and Data

Worldcoin was launched by Alex Blania, Max Novendstern, and Sam Altman, the latter being better known as the CEO of OpenAI. The project’s primary objective is to create a global digital currency that would be adopted universally, bolstering financial inclusivity across the globe. The introduction of Worldcoin comes with the unique proposal of offering free coins to everyone on Earth, aiming to incentivize participation and kickstart its ecosystem.

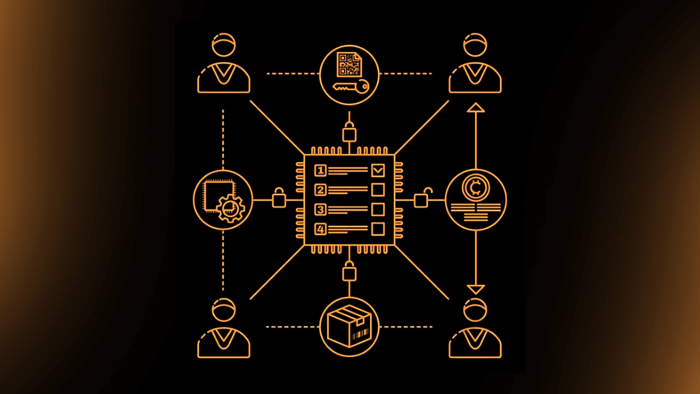

At the core of Worldcoin’s operations is the Orb, a spherical device designed to scan individuals’ eyes to create a unique identifier for each user. This biometric scan allows the system to verify the uniqueness of each participant without storing personal information that could be used to reconstruct their biometric data. This is intended to ensure privacy and security, preventing fraudulent activities such as creating multiple accounts by one person or identity theft.

Technology and Privacy

Worldcoin is built on blockchain technology, leveraging the benefits of decentralized, secure, and transparent transaction ledgers. The currency itself aims to be fast, scalable, and low-cost, addressing common criticisms faced by earlier cryptocurrencies like Bitcoin and Ethereum, particularly concerning transaction speed and costs.

Despite the innovative approach, Worldcoin has faced scrutiny and criticism, primarily concerning privacy and the ethical implications of collecting biometric data. Critics argue that despite the precautions, the potential for misuse or data breaches could pose significant risks. Furthermore, the global nature of the project raises concerns about its compliance with various national regulations on privacy and data protection, such as GDPR in the European Union.

Potential Impacts and Future Prospects

If successful, Worldcoin could significantly impact the global economy and the way people interact with money. By providing a universal digital currency, it could streamline international transactions, reduce transaction fees, and provide a stable financial system accessible to unbanked populations worldwide.

Moreover, the project could pave the way for more widespread use of biometric data in financial transactions, setting a precedent for how technology is employed to secure and manage digital identities.

Worldcoin represents a bold step forward in the realm of digital currencies, proposing a unique solution to some of the most pressing issues facing global financial systems. However, its success will largely depend on the project’s ability to address privacy concerns, navigate regulatory hurdles, and ultimately convince a global audience of its benefits and security. If these challenges can be overcome, Worldcoin might just redefine the future of money. Possibly.