There have been questions regarding what will make the existence of DeFi clients simpler and remove any kind of obstacles for the entry of more up-to-date market members This task considers the future of DeFi as a multichain co-existence.

What will facilitate the burden of DeFi clients and remove a portion of the boundaries to entry for fresher market participants? This task considers the future of DeFi as multichain co-existence.

There have been questions regarding what will make the existence of DeFi clients simpler and remove any kind of obstacles for the entry of more up-to-date market members This task considers the future of DeFi as a multichain co-existence. The role of decentralized trades presently is viewed as a specific amount of crypto exchanging volume or a more realistic side it seems like these stages have a significant duty to play in the savvy economy of the future.

Particularly, automated markets producers have changed the whole game by disposing of the necessity of order books completely and replacing them with liquidity pools. This model was a success for the two brokers executing the trade and liquidity suppliers who animated to supply their tokens and procure charges from brokers. Even periodic liquidity intricacies on DEXes, brought a somewhat broken marketplace it was referenced by the rise of DEX aggregators, platforms will generally make a puddle of the fragmented liquidity into a solitary platform.

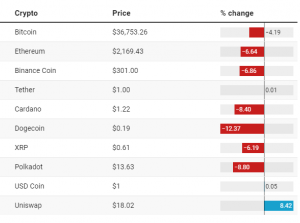

In the majority of the part, these DEX aggregators are have confined intends to interface liquidity pools on Ethereum. This generally diminishes the level of multi-chain comfort implied for exchanging on DEX. Nevertheless, as everything keeps trading volume on DEXes is still neutral rather than most unified trades. Even though Ethereum may be the main organization in the business it isn’t accessible to everyone. It’s not a secret truth that network obstruction and the deficiency of versatility have become the reason for the high exchange expenses on Ethereum. Brokers are focusing on layer 2 solutions and sidechains, for example, Binance smart chain, HECO, and polygon choices, however, the exchange limitations between them refrain them by restricting their decisions significantly.

During certain circumstances, the complicated circumstance including performing of trade joined with these liquidity issues has taken DeFi merchants directly back to incorporated exchanges. The similarity between blockchains is something required at this point. Cross-chain liquidity aggregators have been referencing this issue which is still winning over decentralized trades by gathering liquidity sources from various DEXs from various chains and their cross-chain pools. O3 swap is considered as a cross-chain DEX aggregator which deals with enlarging available token business sectors and expanding liquidity and exchanging volumes which would make the cross-chain transaction more receptive for users in general.

O3 Swap has pronounced itself as the main cross-chain accumulation protocol which permits free exchanging of local resources between heterogenous chains through the technique for setting up ‘aggregator + resource cross-chain pool’ on various public chains and layer 2 allowing clients everywhere to cross-chain exchanges with one click. The project is focusing on the future of DeFi as a multichain co-existence. Meanwhile, it remains by Ethereum, BSC, HECO, polygon, and NEO cross-chain exchanges and four cross-chain pools: USD pool (ERC20-BEP20-HRC20), ETH pool (ERC20-BEP20-HRC20), BTC pool (ERC20-BEP20-HRC20), and USDC pool (ERC20-BEP20-polygon).

With The utilization of special algorithms, cross-chain DEX aggregators see the most prototypical techniques to complete the exchange orders around blockchain environments. This pivotal detail will help in facilitating the burden of existing DeFi clients and will also remove some of the snags for the newer market members.