The metaverse has the ability to transport us to previously unreachable realms, such as those found solely in science fiction books and movies. Experiences that are immersive and engaging that take place in virtual worlds are intriguing options for many businesses looking to transform the manner in which they connect with their consumers.

The metaverse not only assists in the replication of the actual world in the virtual world but also provides the latter with the means to use various technological advancements. Therefore, in recent years, there has been an enormous surge in the number of people pursuing occupations related to the metaverse.

Getting Into It

We are now on the cusp of a new technological revolution that is being referred to as the Metaverse. It is anticipated that when it is finally finished, it will be the most advanced digital platform that humans have ever developed. It will serve as a platform for all activities, including work, athletics, and entertainment.

This platform will provide users with a new method of engagement. This which will be a simulation in three dimensions that will enable them to fully submerge themselves in a specific activity.

The Metaverse will pave the way for the subsequent stage of digital transformation. This will eventually alter the way in which we interact with one another online. It will shift the focus from two-dimensional material to a three-dimensional, spatial virtual world.

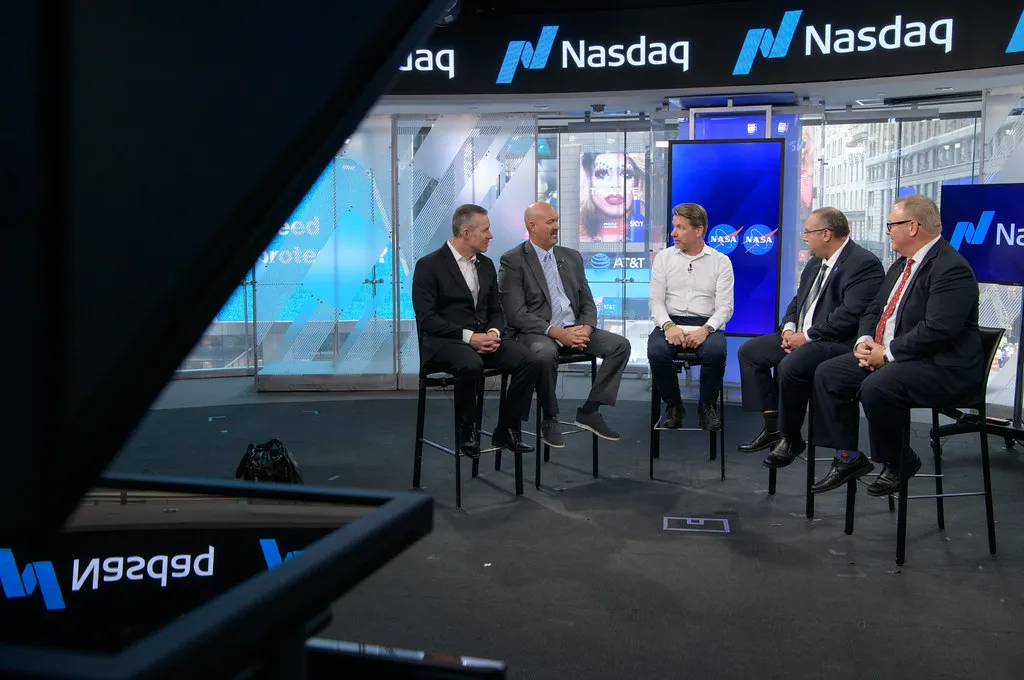

The research and development of Metaverse are supported by massive investments totaling billions of dollars from market giants such as Meta, Epic, and Nvidia.

And there is a reason for it: big financial organizations like as Morgan Stanley have forecast that the market for the Metaverse would be worth multiple trillions of dollars.

Furthermore, this new market will give rise to a variety of employment opportunities. Many of these did not exist before the advent of the Metaverse.

Some Metaverse Jobs You Can Get

Developer

Nobody should anticipate that the metaverse would develop on its own. Creating a virtual environment on par with the metaverse calls for the assembly of a vast ecosystem with a multitude of components. All of these must be linked to one another. Even if you have the necessary technology and software to establish the metaverse, there is still something more you need in order to construct the enormous virtual places that are linked.

Architect

Skeuomorphic habitats, or digital copies of physical locations, will likely predominate in the early stages of the Metaverse. For example, a virtual copy of the TIME Square or Washington Monument, for example.

This eases the transition from the actual world to the virtual one for first-time users and makes for a more pleasant experience overall. Because of this, architects will find that many of the talents they’ve honed in the construction of physical structures and environments are applicable and useful in the Metaverse as well.

Cyber Security

Fraud, cyberattacks, and other unintended outcomes may all easily affect the metaverse. As a result, the metaverse is a fertile ground for the professional advancement of cyber security professionals. Experts in cyber security for the metaverse’s virtual worlds would primarily be responsible for preventing assaults in real-time. Moreover, they must recognize security threats and guarantee a reevaluation and revision of relevant laws and procedures.

3D Designer

3D designers will design 3D things for the virtual realm. These objects might be a big size, such as a whole city district. Or they could be on a tiny scale, such as the t-shirt that an avatar wears.

A Few Tips

Learn A Skill If You (If You Don’t Have One Already)

If you want to find employment in the metaverse, you’ll need to demonstrate that you have the appropriate level of experience or expertise. Experience with Javascript, React, Typescript, Node.js, Git, distributed systems, API integrations, etc. All other abilities are required of an engineer working in a frontend, backend, or full-stack job.

Socialize and Gain Experience

Internships are the best way to test the waters of a potential career path. If you’re a student at any level and you have the chance to intern, you should absolutely take it. You’ll learn a ton about the Web3 industry and build valuable professional skills. Look for a fellow crypto enthusiast to collaborate with on whatever endeavor you two have in mind.

When you expand your circle of contacts, more doors of opportunity will open for you. The beautiful thing about searching for a job in the metaverse is that you may meet folks in both the actual world and the virtual worlds you visit.

Develop Your Brand

It’s time to develop your personal brand once you’ve shown your expertise and begun to network at the professional level. Your own unique identity. Make sure your portfolio is up to date with design drawings, avatars you’ve produced, product design templates, and so on.

If you’re a designer or seeking a creative career in the metaverse. In order to demonstrate your abilities as an engineer, you may want to compile a portfolio of your previous work. A brilliant social media campaign, viral NFT creation, or growth hacking might get you a marketing gig in the metaverse.

Bottomline

The robust basis for the future of the metaverse is provided by the many employment possibilities available inside the metaverse. This is in addition to the promises connected to the metaverse itself.

On the other hand, in order to acquire the employment relating to the metaverse that you seek, you will need to take a guided method.

For instance, you need to understand all there is to know about the metaverse. Beginning with the principles of the metaverse and progressing all the way up to the difficult issues and related technologies.

As soon as you have a clear notion of the skill set you can provide to an organization. You may start looking for jobs. And the first step in uncovering those incredible opportunities is to pinpoint the exact region of the Metaverse in which your interest and enthusiasm are the highest.