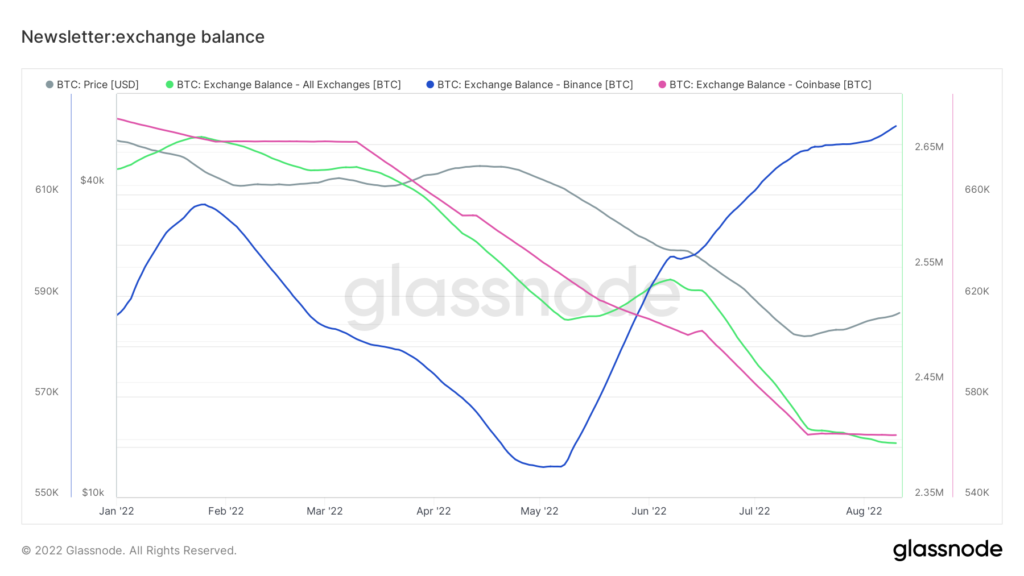

According to CoinMarketCap, the entire value of the crypto market has seen a decline of 5.49 percent over the course of the last twenty-four hours. Due to the daily decline, the total value of the crypto market cap has now reached $973.34 billion.

Over the course of the previous day, the prices of each of the top 10 cryptocurrencies by market capitalization fell by at least 3%. This decline occurred across the board. Bitcoin (BTC) and Ethereum (ETH) witnessed their values fall by 5.46 percent and 9.13 percent, respectively, during the course of the previous day. Because of this, both of their weekly performances have taken a turn for the worst as well.

Over the course of the previous day, the value of Cardano (ADA) fell by 8.57 percent. In an analogous manner, the price of Ripple (XRP) has decreased by 3.98%, the price of Binance Coin (BNB) has decreased by 4.94%, the price of Solana (SOL) has decreased by 7.84%, and the price of Dogecoin has decreased by 6.17%. Every one of these tokens has likewise displayed a poor performance for the previous week.

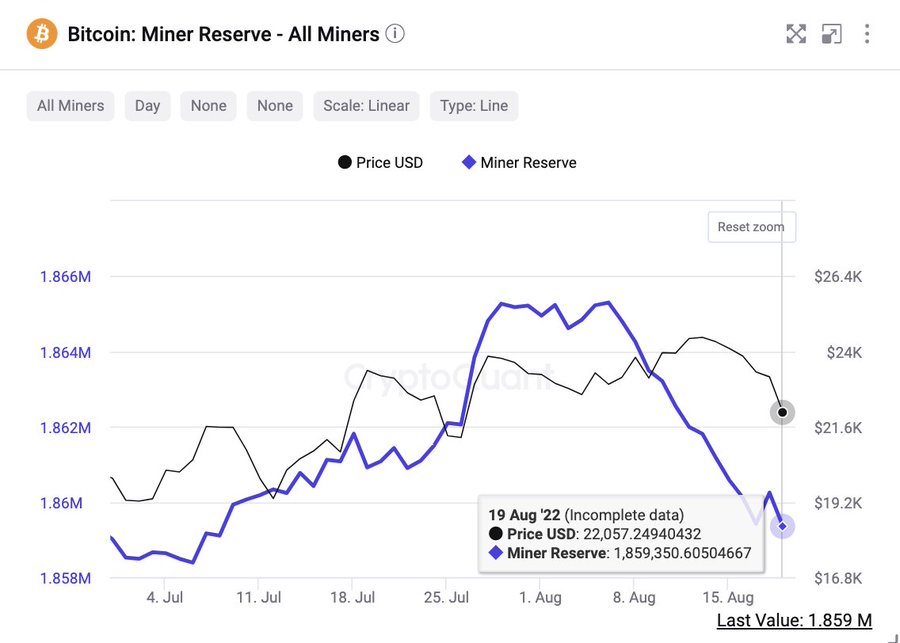

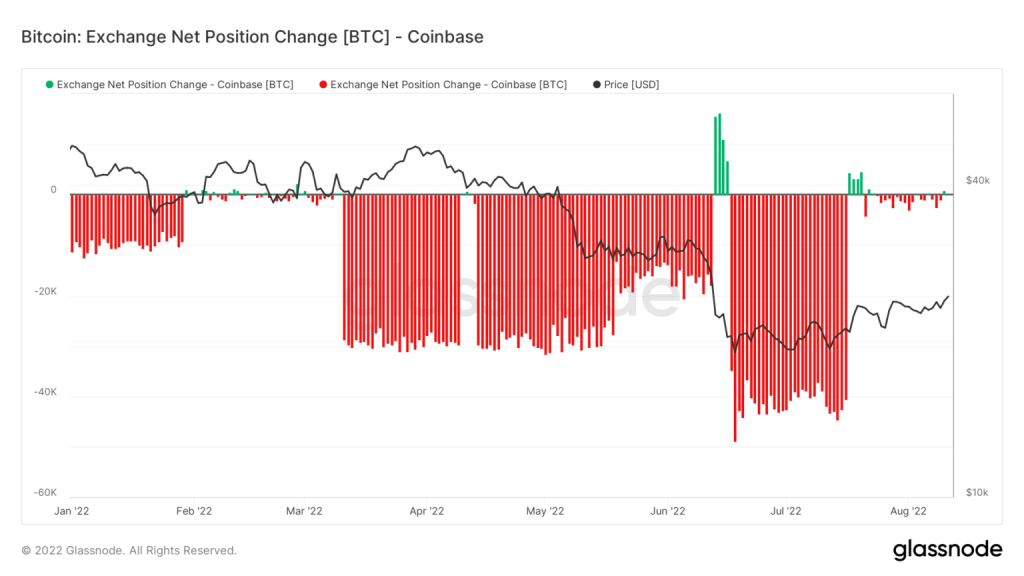

The daily chart for the dominant player in the cryptocurrency market shows how Bitcoin’s price made an effort to break above the 9 Exponential Moving Average (EMA) line, but it was greeted with strong selling pressure. This is around the same time when a selloff was taking place over the whole market.

After falling below the RSI simple moving average line, the Relative Strength Index (RSI) indicator is now in the oversold region; however, the slope of the indicator has leveled out to neutral. An examination of the indicator in further detail reveals the presence of bullish divergence in the market. This may be interpreted to suggest that the price of BTC will be making a move upward during the next several days.

If anything like this were to occur, the rest of the crypto market would act similarly, and the total capitalization of the crypto market would see a minor recovery.