Coinposters

Explaining Smart Contracts: What to Know

Smart contracts play a very important part as an introduction to Blockchain technology since they assist to make the transactions that are taking place safer and secure while also allowing them to work in an ordered way.

In addition, it assists other components, such as programs operating on these platforms, in becoming even more accessible. However, what exactly is a smart contract?

What is Smart Contract?

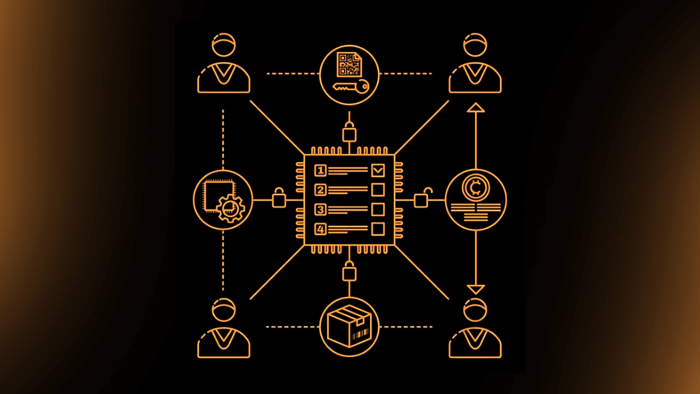

A self-executing contract is known as a smart contract. In this kind of contract, the terms of the deal between the buyer and the seller are encoded directly into lines of code.

The code as well as the contracts that are stored inside it are spread out throughout a blockchain network that is decentralized and dispersed. The execution is under the control of the code, and all transactions are both trackable and irreversible.

The automation of processes that would normally call for the participation of a middleman is one of the most significant advantages offered by blockchain networks.

For instance, a smart contract may make it such that a client does not require a bank’s permission to transfer funds from the customer to the freelancer.

This means that the procedure can take place automatically. All that is necessary is for the two parties involved to reach a consensus on a single idea.

Why Smart Contract?

Developers are able to create a broad range of decentralized applications and tokens thanks to the use of smart contracts.

They are utilized in anything from new financial tools to logistics and gaming experiences. And just like any other cryptocurrency transaction, they are kept on a blockchain.

It is often not possible to revoke or alter the execution of a smart contract once the software that implements the contract has been posted to the blockchain.

Apps that are driven by smart contracts are sometimes referred to as “decentralized applications” or “dapps.” These apps may contain decentralized finance technology, also known as “DeFi,” which is designed to revolutionize the banking sector.

DeFi applications make it possible for holders of cryptocurrencies to participate in complicated financial operations, including savings, loans. And also insurance, without the involvement of a bank or any other traditional or alternative financial institution. And from any location around the globe.

How it Works

The following reasoning is used in smart contracts, which are computer programs that run on blockchains and are tamper-proof. For instance, “if/when x event occurs, then do y action.”

It is possible for a single smart contract to include a number of distinct conditions. And it is also possible for a single application to have a number of different smart contracts that work together to enable a network of related procedures.

In addition, there are other programming languages designed specifically for smart contracts, with Ethereum’s Solidity being the most widely used.

Any programmer has the ability to design a smart contract and publish it on a public blockchain for their own reasons. For example, a personal yield aggregator might be created that would automatically move a user’s assets to the application with the best earning potential.

However, many smart contracts include a number of separate parties, each of which is considered to be autonomous. And which may or may not know one another and may or may not trust one another.

The smart contract will describe precisely how users may engage with it. This includes who can communicate with the smart contract. And what kinds of inputs will result in what kinds of outputs. Users will be able to determine exactly how they want to interact with the smart contract.

The end consequence of this process is the development of multi-party digital agreements that transition from their current probabilistic state, in which they will probably execute as planned, to a new deterministic state, in which it is assured that they will execute in accordance with the code.

Pros

- Safety and reliability: Strong tamper-proof, uptime, and accuracy assurances that the contract will execute on time. According to its conditions may be obtained by having the contract logic executed and validated in a redundant manner by a decentralized network of nodes.

- Precision, Swiftness, and Efficiency: After the fulfillment of a condition, the contract is immediately put into effect. Because smart contracts are digital and automated, there is no paperwork to deal with. And there is no time spent correcting mistakes that may arise when filling out documents by hand. This eliminates a significant source of potential frustration and saves a significant amount of time.

- Protection: Running the contract on a decentralized blockchain infrastructure ensures that there will be no central point of failure that can be attacked. There will be no centralized intermediary that can be bribed. And no mechanism that either party or a central administrator can use to tamper with the outcome of the transaction.

Closing Thoughts

Because the underlying blockchains that smart contracts operate on are isolated networks, this is one of the intrinsic constraints of smart contracts. This means that blockchains do not have connectivity to the outside world that is built into them.

Without a connection to the outside world, smart contracts are unable to interact with other systems in order to verify the existence of real-world events. Nor are they able to access computing resources that are both efficient and cost-effective.

Without this connection, the capabilities of smart contracts are comparable to those of a computer that lacks Internet access. They are unable to ascertain the worth of an asset before carrying out a deal.

They are unable to examine the monthly average rainfall before settling a crop insurance claim. And they are unable to verify that products have arrived before paying a supplier.

Many financial institutions and insurance companies are already making use of smart contracts in the day-to-day operations of their businesses.

Because of this, smart contracts already exist and are being tested in situations that take place in the real world. It will not be long until they become an integral part of our day-to-day activities and routines.

Regardless of the debate that came before it, there is still a significant distance to go before everything is regulated by a smart contract.

Latest

Blockchain

16 Jan 2024

Blockchain

31 Aug 2023

Blockchain

24 Jun 2023

Blockchain

24 Jun 2023

Blockchain

24 Jun 2023

Blockchain

23 Jun 2023