James Carter

What is the History of Bitcoin Hard Forks?

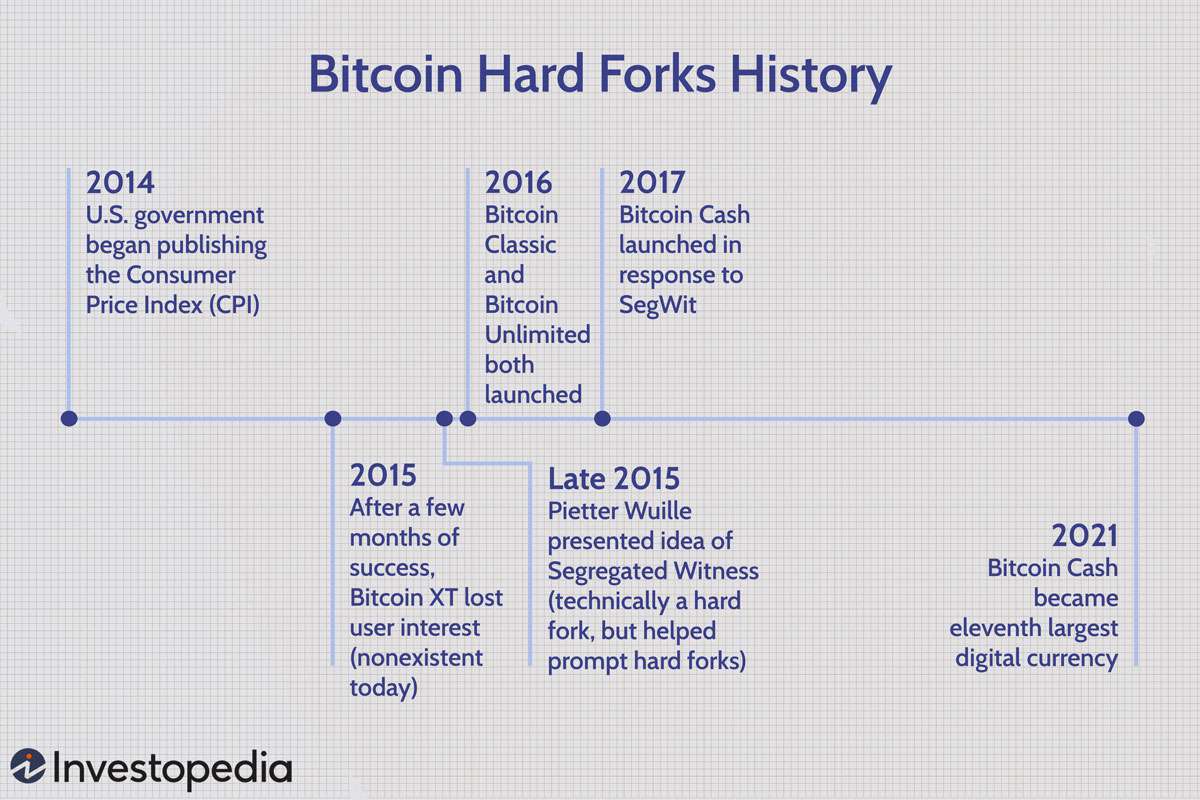

The rapid rise and widespread adoption of Bitcoin, the pioneering cryptocurrency, has not been without its challenges. One of the key issues that has emerged throughout Bitcoin’s history is the occurrence of hard forks. In this article, we will delve into the history of Bitcoin hard forks, exploring their motivations, impact, and the lessons learned from these events.

Early Bitcoin Forks

Bitcoin XT:

Bitcoin XT was one of the earliest Bitcoin hard forks, introduced in August 2015. It was spearheaded by Mike Hearn, a prominent Bitcoin developer, with the intention of increasing the block size limit of the Bitcoin blockchain. The fork aimed to address scalability concerns and enable faster transaction processing. However, Bitcoin XT faced significant resistance from the Bitcoin community, leading to a lack of consensus and limited adoption. Ultimately, Bitcoin XT faded into obscurity, serving as a precursor to future debates surrounding block size.

Bitcoin Classic:

In early 2016, Bitcoin Classic emerged as another attempt to address the scalability issue. Led by prominent developers such as Gavin Andresen and Jonathan Toomim, Bitcoin Classic proposed a simple and straightforward solution: increasing the block size from 1MB to 2MB. The goal was to enhance transaction capacity and alleviate congestion on the Bitcoin network. However, similar to Bitcoin XT, Bitcoin Classic failed to gain sufficient consensus and lost momentum over time.

The Bitcoin Unlimited Fork

Bitcoin Unlimited, introduced in 2016, aimed to tackle the scalability challenge by removing the block size limit altogether. This approach aimed to allow the market to determine the optimal block size dynamically. Bitcoin Unlimited gained traction and support from some miners and nodes, sparking intense debates within the Bitcoin community. However, concerns were raised regarding the potential centralization of power and the security implications of unlimited block sizes. As a result, Bitcoin Unlimited failed to gain widespread acceptance, leading to a fragmented community and continued disagreements.

Bitcoin Cash

Bitcoin Cash, born out of a hard fork in August 2017, was a significant milestone in Bitcoin’s history. The fork was primarily driven by differences in vision regarding the scalability and transaction capacity of Bitcoin. Bitcoin Cash aimed to increase the block size to 8MB, allowing for more transactions to be processed per block and reducing transaction fees. It gained support from a significant portion of the community, including influential miners and businesses. Bitcoin Cash experienced notable adoption and achieved higher transaction throughput compared to Bitcoin. However, it also faced criticisms for potentially undermining the decentralization of the network.

SegWit2x

Segregated Witness (SegWit), a proposed improvement to the Bitcoin protocol, aimed to address both scalability and transaction malleability issues. SegWit separated transaction signature data, reducing the overall size of transactions and enabling more transactions to fit within a block. However, the activation of SegWit required a consensus from the Bitcoin community. SegWit2x emerged as an agreement in 2017 to implement SegWit and increase the block size to 2MB. Despite initial support, the SegWit2x fork faced substantial opposition from some community members, including influential developers. Ultimately, the fork was abandoned due to a lack of consensus, leading to a significant market reaction and increased volatility in the Bitcoin ecosystem.

Bitcoin Gold

Bitcoin Gold, launched in October 2017, aimed to address concerns regarding the centralization of mining power on the Bitcoin network. It introduced a new mining algorithm called Equihash, which aimed to promote decentralized mining by making specialized mining hardware less effective. The fork also made adjustments to the difficulty adjustment algorithm, making it more responsive to changes in mining power. Bitcoin Gold faced some challenges in its early stages, including a successful 51%

Bitcoin Diamond

Bitcoin Diamond emerged as a hard fork of Bitcoin in November 2017, introducing several key improvements and features. The fork aimed to address perceived issues with transaction speed and privacy. Bitcoin Diamond implemented the X13 hashing algorithm, which increased the speed of block generation and improved overall transaction processing. Additionally, it introduced features such as increased block size (10MB), enhanced privacy through encryption, and the adoption of a new address format. However, Bitcoin Diamond faced skepticism and criticism from some members of the cryptocurrency community, questioning its legitimacy and long-term viability.

Other Notable Bitcoin Forks

Apart from the aforementioned hard forks, several other notable Bitcoin forks have taken place:

Bitcoin Private:

Bitcoin Private, launched in March 2018, aimed to enhance privacy features by combining the privacy-centric cryptocurrency, ZClassic, with Bitcoin. It employed the zk-SNARKs technology to enable shielded transactions, providing users with enhanced privacy options.

Bitcoin SV:

Bitcoin Satoshi Vision (Bitcoin SV) emerged in November 2018 as a result of a contentious hard fork within the Bitcoin Cash community. Bitcoin SV aimed to preserve the original vision of Bitcoin by increasing the block size to 128MB and restoring some of the earlier Bitcoin protocol features.

Bitcoin ABC:

Bitcoin ABC, launched as part of the Bitcoin Cash network upgrade in November 2018, implemented several protocol improvements, including the introduction of canonical transaction ordering and the enabling of smart contract capabilities on the Bitcoin Cash blockchain.

Lessons Learned and Future Outlook

The history of Bitcoin hard forks provides valuable insights and lessons for the cryptocurrency community:

Governance Challenges:

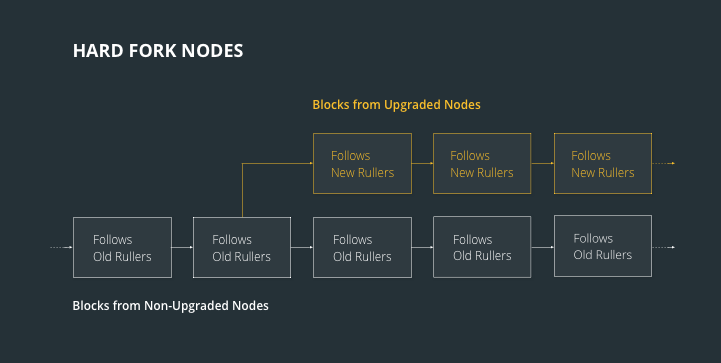

Hard forks have highlighted the governance challenges in decentralized systems. Disagreements over fundamental protocol changes and the lack of consensus mechanisms have resulted in fragmented communities and competing forks.

WATCH THE VIDEO BELLOW

Scalability Trade-offs:

The various approaches taken by hard forks to address scalability, such as increasing block sizes or implementing new algorithms, have demonstrated the trade-offs between transaction throughput, decentralization, and security.

Market Dynamics:

The market response to hard forks has been mixed, with some forks gaining significant support and adoption, while others struggle to establish themselves. Factors such as community consensus, developer support, and market demand play critical roles in the success or failure of a fork.

Looking ahead, the future of Bitcoin hard forks remains uncertain. The maturation of layer-two scaling solutions like the Lightning Network may mitigate the need for contentious hard forks in addressing scalability challenges. However, the decentralized nature of cryptocurrencies and divergent interests within the community may continue to give rise to future forks as a means of addressing governance and protocol improvements.

Summary

The history of Bitcoin hard forks reflects the ongoing evolution and challenges faced by the cryptocurrency ecosystem. Early forks like Bitcoin XT and Bitcoin Classic laid the groundwork for future debates on scalability, while forks like Bitcoin Cash and SegWit2x ignited significant community discussions. Each fork brought its unique vision, improvements, and controversies.

As the cryptocurrency landscape continues to evolve, it is essential to recognize the lessons learned from Bitcoin hard forks. Balancing scalability, decentralization, security, and community consensus remains a delicate challenge. The future of Bitcoin and its potential forks will depend on the ability of stakeholders to navigate these complexities while fostering innovation and maintaining the fundamental principles of decentralization that underpin cryptocurrencies.

Latest

Bitcoin

09 May 2024

Bitcoin

19 Apr 2024

Bitcoin

16 Jan 2024

Bitcoin

31 Aug 2023

Bitcoin

24 Jun 2023

Bitcoin

24 Jun 2023