James Carter

What is Bitcoin Hard Forks?: Evolution and Implications

Bitcoin, the pioneering cryptocurrency, has revolutionized the financial landscape since its inception. Built on blockchain technology, Bitcoin operates through a decentralized network that relies on a consensus mechanism to validate transactions. Forks, a term commonly associated with blockchain technology, refer to the divergence of a blockchain into separate paths. In this article, we will delve into the concept of Bitcoin hard forks, examining their definition, characteristics, reasons, process, impact, challenges, and strategies for dealing with them.

Definition and Overview of Bitcoin

Before delving into hard forks, let’s briefly understand Bitcoin itself. Bitcoin, introduced in 2008 by an anonymous individual or group using the pseudonym Satoshi Nakamoto, is a decentralized digital currency that operates on a peer-to-peer network. It uses blockchain technology, a distributed ledger that records all Bitcoin transactions. The blockchain ensures transparency, security, and immutability of transactions, making it resistant to fraud and manipulation.

Explanation of Forks in the Context of Blockchain Technology

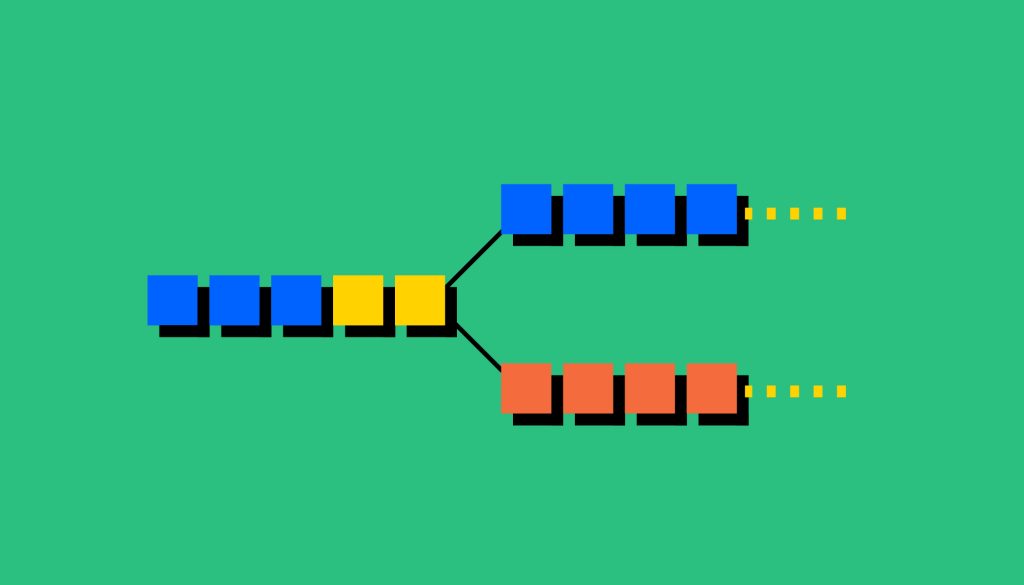

In the context of blockchain technology, a fork refers to the situation where a single blockchain splits into two separate chains, each following a different set of rules. Forks can be classified into two main types: soft forks and hard forks. A soft fork is a backward-compatible upgrade, meaning the new rules introduced are still compatible with the old ones. On the other hand, a hard fork introduces rule changes that are not backward-compatible, resulting in a complete divergence of the blockchain.

Introduction to Bitcoin Hard Forks

A Bitcoin hard fork occurs when there is a fundamental change in the protocol rules, resulting in the creation of a new blockchain and a new cryptocurrency. This process requires consensus among the Bitcoin community, as the majority of network participants must agree to adopt the new rules. Hard forks aim to address various issues, including disagreements over protocol changes, scalability improvements, changes in mining algorithms, and governance concerns.

Understanding Bitcoin Hard Forks

Definition and Purpose of a Hard Fork

A hard fork is a radical upgrade to the Bitcoin protocol that also introduces significant changes to its rules. The primary purpose of a hard fork is to diverge from the existing blockchain and create a separate chain with its own set of rules. The new chain may have different features, scalability enhancements, or governance structures compared to the original Bitcoin blockchain.

Key Characteristics of a Bitcoin Hard Fork

Blockchain Divergence: During a hard fork, the blockchain splits into two separate chains, with each chain maintaining its transaction history from the point of the fork. This also leads to the creation of two distinct and independent cryptocurrencies.

Creation of a New Cryptocurrency: A hard fork typically results in the creation of a new cryptocurrency alongside the original one. Holders of Bitcoin at the time of the fork receive an equal amount of the new cryptocurrency, reflecting their ownership on the new chain.

Changes to Protocol Rules: Hard forks allow for significant changes to the Bitcoin protocol, enabling improvements in areas such as scalability, transaction speed, security, or consensus mechanisms. These changes aim to address perceived limitations or weaknesses in the original Bitcoin blockchain.

Examples of Notable Bitcoin Hard Forks

Several notable Bitcoin hard forks have taken place, each resulting in the creation of a new cryptocurrency. Here are a few examples:

Bitcoin Cash (BCH): Launched in August 2017, Bitcoin Cash aimed to address the scalability issue of the original Bitcoin blockchain. It increased the block size limit, allowing for more transactions per block and faster confirmation times.

Bitcoin SV (BSV): Arising from a contentious hard fork in November 2018, Bitcoin SV, short for “Satoshi Vision,” aimed to restore what its proponents believed were the original principles and vision of Bitcoin. It emphasized larger block sizes and aimed to enable more transaction throughput.

Bitcoin Gold (BTG): Launched in October 2017, Bitcoin Gold aimed to democratize the mining process by introducing a new mining algorithm called Equihash. It sought to make mining more accessible to individual miners using standard computer hardware instead of specialized mining equipment.

Reasons for Bitcoin Hard Forks

Bitcoin hard forks are driven by various factors and motivations within the cryptocurrency community. Some common reasons include:

Disagreements over Protocol Changes:

Disagreements can arise within the Bitcoin community regarding proposed changes to the protocol. Different factions may have divergent visions on how Bitcoin should evolve, leading to conflicts that can only be resolved through a hard fork.

Desire for Enhanced Scalability:

Scalability has been a persistent challenge for Bitcoin. The original blockchain’s limited block size and transaction throughput have led to congestion and slower confirmation times. Hard forks may seek to address scalability concerns by increasing block sizes or introducing new solutions like off-chain scaling techniques.

Improvement of Mining Algorithms:

The mining process plays a crucial role in securing the Bitcoin network. Some hard forks may introduce changes to mining algorithms to make them more resistant to centralized mining operations or to promote wider participation in the mining ecosystem.

Addressing Governance Issues:

Governance is a critical aspect of any decentralized network. Disagreements over governance models and decision-making processes can lead to hard forks as different groups within the Bitcoin community seek to establish their preferred governance structures.

Process and Impact of Bitcoin Hard Forks

Fork Initiation and Community Consensus

Before a hard fork can occur, there needs to be a broad consensus among the Bitcoin community. This consensus involves convincing a significant portion of network participants, including miners, developers, exchanges, and users, to adopt the proposed changes. Discussions, debates, and open forums play a vital role in gathering support and building consensus for the hard fork.

Technical Implementation and Network Split

Once consensus is achieved, the technical implementation of the hard fork begins. Developers work on modifying the Bitcoin software to incorporate the new rules and features. At a predetermined block height or timestamp, the fork is activated, resulting in the split of the blockchain into two separate chains. The original chain continues to follow the existing rules, while the new chain operates with its modified set of rules.

Forked Chain and Original Chain Coexistence

After the fork, both the forked chain and the original chain continue to exist independently. Holders of Bitcoin at the time of the fork receive an equal amount of the new cryptocurrency associated with the forked chain. Exchanges and wallet providers decide whether to support the forked cryptocurrency, allowing users to access and trade their newly acquired coins.

Effects on Users and Stakeholders

Ownership of Forked Coins: Bitcoin holders who possess their private keys or hold their Bitcoin on platforms that support the fork typically receive an equal amount of the new cryptocurrency associated with the forked chain. This gives them the opportunity to explore and utilize the newly created coins.

Potential Price Volatility: The announcement and execution of a hard fork often introduce volatility in the market. Traders and investors may react differently to the fork, leading to price fluctuations in both the original and forked cryptocurrencies. It is important for users to be cautious and aware of these market dynamics.

Community Fragmentation: Hard forks can result in community fragmentation, as different factions align themselves with either the original chain or the forked chain. This can lead to divisions within the community, debates on the legitimacy of the fork, and competing narratives about the future of Bitcoin.

Challenges and Risks Associated with Bitcoin Hard Forks

Security Concerns and the Risk of Replay Attacks

One of the significant challenges associated with Bitcoin hard forks is security. When a hard fork occurs, the two chains share the same transaction history up until the point of the fork. This shared history opens up the possibility of replay attacks. A replay attack happens when a transaction intended for one chain is maliciously or unintentionally replayed on the other chain, leading to unintended consequences.

To mitigate this risk, developers and users implement measures such as unique transaction signatures or utilizing specific tools and services that separate transactions on each chain. It is crucial for users to exercise caution and take necessary precautions when conducting transactions during and after a hard fork to prevent potential replay attacks.

Loss of Consensus and Network Consensus Rules

A hard fork in the Bitcoin network can create a situation where there is a loss of consensus among participants. With the creation of a new chain, some users may choose to migrate and support the new cryptocurrency, while others may remain loyal to the original Bitcoin blockchain. This division can lead to a fragmentation of the community and a lack of consensus on the direction and governance of Bitcoin.

Additionally, hard forks can create confusion and complexity in the network’s consensus rules. With two or more chains operating independently, each with its own set of rules, it becomes crucial for users and developers to understand and adhere to the specific consensus rules of the chain they are interacting with. Failure to do so can result in transaction failures or potential loss of funds.

Community Division and Conflicts

Hard forks often result in deep divisions within the Bitcoin community. Different factions may have contrasting opinions on the proposed changes, leading to heated debates and conflicts. These divisions can create a hostile environment and impact the overall cohesion and progress of the cryptocurrency ecosystem.

It is essential for the community to engage in open dialogue and strive for constructive discussions to address concerns and find common ground. Collaboration and compromise are crucial for maintaining a healthy and united community despite differing viewpoints.

Impact on Bitcoin’s Reputation and Market Stability

Bitcoin is the most prominent and widely recognized cryptocurrency globally. Hard forks, especially those accompanied by controversies or contentious debates, can impact Bitcoin’s reputation and market stability. The perceived instability or lack of consensus may introduce uncertainty among investors and traders, leading to price volatility and potential market disruptions.

However, it is worth noting that Bitcoin has proven to be resilient over the years, successfully navigating through multiple hard forks. The ecosystem’s ability to adapt and the underlying strength of the technology has helped maintain Bitcoin’s position as the leading cryptocurrency in terms of market capitalization and adoption.

WATCH VIDEO BELOW

Strategies for Dealing with Bitcoin Hard Forks

Wallet and Exchange Support for Forked Coins

When a hard fork occurs, it is crucial to ensure that the wallet or exchange you use supports the forked cryptocurrency if you want to access and manage the newly created coins. It is advisable to research and choose reputable wallets and exchanges that have a track record of supporting forks and providing timely access to forked coins.

Security Precautions for Users

As with any cryptocurrency transaction, users should exercise caution and follow security best practices during and after a hard fork. This includes keeping private keys secure, enabling two-factor authentication, and verifying the authenticity of wallet addresses before making any transactions.

Assessing the Legitimacy and Credibility of Forks

Not all hard forks are created equal, and some may lack legitimacy or credible development teams behind them. It is important for users to conduct thorough research and due diligence to evaluate the legitimacy and potential value of the forked cryptocurrency. This includes assessing the development team’s expertise, community support, roadmap, and overall credibility.

Considerations for Long-term Investment and Risk Management

If you hold Bitcoin and receive forked coins, it is essential to carefully consider the long-term prospects and risks associated with the new cryptocurrency. Evaluating factors such as the technology, adoption potential, market demand, and overall viability of the forked coin can help inform your investment decisions.

Additionally, risk management is crucial when dealing with hard forks. It is generally recommended to only allocate a portion of your portfolio to forked coins, as they often come with higher volatility and uncertainty compared to established cryptocurrencies like Bitcoin. Diversifying your investment across different assets and conducting regular portfolio reviews can help mitigate risks associated with hard forks.

Summary

Bitcoin hard forks represent an essential aspect of the cryptocurrency ecosystem. They allow for innovation, experimentation, and the exploration of different approaches to address the challenges faced by Bitcoin. However, hard forks also introduce complexities, challenges, and potential risks.

Understanding the definition, characteristics, reasons, process, and impact of Bitcoin hard forks is crucial for users, investors, and developers in navigating the evolving landscape of cryptocurrencies. It is essential to stay informed, conduct thorough research, and exercise caution when engaging with hard forks to protect your assets and make informed decisions.

Latest

Technology

21 Feb 2026

Technology

13 Feb 2026

Technology

07 Feb 2026

Technology

06 Feb 2026

Technology

05 Feb 2026

Technology

03 Feb 2026