David Agullo

What Are 51% Attacks in Cryptocurrencies?

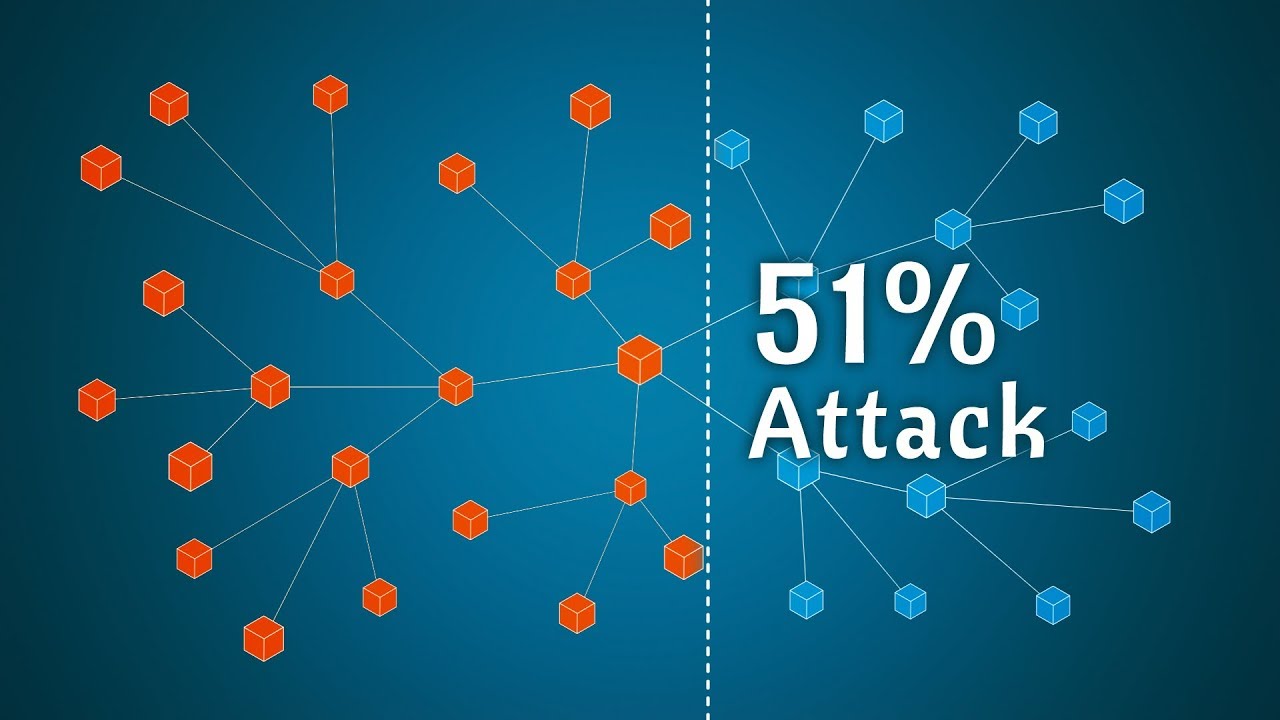

Cryptocurrencies – A 51% attack is when a solitary digital currency miner or gathering of excavators gains control of half of an organization’s blockchain. Such attacks are the major threats for individuals who use and purchase cryptocurrencies.

The 51% attack situation is exceptional, generally due to the logistics, equipment, and expenses needed to do one. But a fruitful block attack could have extensive ramifications for the cryptocurrency market and the individuals who put resources into it.

Digital currency investing can be conceivably rewarding however it implies a more serious level of risk compared with stock or bond contributing. If a financial backer is thinking about adding cryptocurrencies to their portfolio, Understand that the ramifications of a 51% attack.

How a 51% Attack Affects Cryptocurrency Investors?

A 51% attack is not a general incidence however it is not something that can be forgotten about. For cryptocurrency financial backers, the biggest danger related to a 51% attack might be the degrading of a specific cryptocurrency.

If a cryptocurrency is liable to block assaults, that could make financial backers lose trust in the market. Such an event could make the cost of the cryptocurrency breakdown.

Fortunately, there are constraints to what a miner who organizes a 51% attack can do. For instance, somebody doing a block attack wouldn’t have the option to:

- Reverse exchanges made by others

- Alter the number of coins or tokens produced by a block

- Transact with coins or tokens that don’t belong to them

Financial backers might have the option to protect themselves against the possibility of a 51% attack by putting resources into bigger, more settled digital currency networks versus smaller ones. The bigger a blockchain grows, the more troublesome it becomes for rogue miners to do an attack on it. More modest organizations, on the other hand, might be more helpless against a block attack.

Is Cryptocurrency Investing a Good Idea?

Digital forms of money can assist with boosting portfolio expansion, however, there are risks to know about. Current digital currency rules and guidelines offer some security to financial backers, but in general, the market is far less controlled than stocks, common assets, and other protections. Here are some expected potential gains and drawbacks of putting resources into cryptocurrencies.

Pro of Cryptocurrencies Investing

• Bigger prizes. Compared with stocks and securities, digital money investing could yield a lot of returns. In 2020, for instance, Bitcoin surged 159% higher.

• Liquidity. Liquidity estimates how effectively a resource can be converted to money or its same. Well-known digital currencies like bitcoin are more liquid resources, which might speak to investors focused on momentary exchanging procedures.

• Transparency. Blockchain networks provide almost lucidity to investors, as new exchanges are on record for the public’s viewing pleasure. That can make cryptocurrency a considerably more venture compared with more obscure speculations like a mutual fund or a Real estate investment trust (REIT).

Cons of Cryptocurrencies Investing

• Volatility. Digital currency can be very unstable, with wide changes in price developments. That volatility could put a financial backer at a bigger risk of losing money on cryptocurrency speculations.

• Difficult to comprehend. Learning the intricate details of cryptocurrency exchanging, blockchain innovation, and digital coin mining can be more convoluted than figuring out how a stock, ETF, or index fund works. That could diminish its allure for a fresher investor who’s simply learning the market.

• Not hands-off. If an investor is inclining towards a passive speculation technique, the digital currency may not be the best fit. Exchanging digital currencies focuses on the present moment, making it more appropriate for dynamic brokers.

The Takeaway

Cryptocurrency investing may engage an investor in case they are open to facing more challenges to seek after good yields. If an investor is new to digital currency exchanging, the possibility of a 51% attack may appear to be scary. Understanding how they work and the probability of one happening can help them feel more positive.

Latest

Bitcoin

21 Feb 2026

Bitcoin

13 Feb 2026

Bitcoin

07 Feb 2026

Bitcoin

05 Feb 2026

Bitcoin

03 Feb 2026