James Carter

The Altcoin Season Index: A Comprehensive Guide to Understanding and Utilizing Altcoin

The cryptocurrency market is known for its volatility and ever-changing dynamics. Within this market, altcoins, or alternative cryptocurrencies to Bitcoin, play a significant role in shaping investor sentiment and market trends. Understanding when altcoin seasons occur and how to identify them can be crucial for investors and traders looking to maximize their profits. This is where the Altcoin Season Index (ASI) comes into play.

I. Overview of the Altcoin Season Index (ASI)

A. Definition and Purpose of ASI

The Altcoin Season Index (ASI) is a metric designed to gauge the overall sentiment and activity levels of altcoins within the cryptocurrency market. It provides a quantitative assessment of altcoin market conditions, helping investors and traders identify periods when altcoins are experiencing increased activity and outperforming Bitcoin.

B. Methodology and Factors Considered in Calculating ASI

The ASI takes into account several key factors to determine the strength of altcoin seasons. These factors include:

1. Market Capitalization of Altcoins

Market capitalization represents the total value of a cryptocurrency, calculated by multiplying its circulating supply by its current price. The ASI considers the market capitalization of altcoins relative to Bitcoin’s market capitalization to assess the overall health and significance of altcoins within the market.

2. Altcoin Dominance

Altcoin dominance measures the percentage share of altcoins’ market capitalization compared to the total cryptocurrency market capitalization, including Bitcoin. The ASI considers altcoin dominance as an indicator of altcoins’ influence and their ability to drive market trends.

3. Altcoin Trading Volume

Trading volume reflects the amount of a cryptocurrency being bought and sold within a specific timeframe. The ASI takes into account the trading volume of altcoins to determine the level of activity and investor interest in these cryptocurrencies.

4. Altcoin Price Movements

The ASI analyzes altcoin price movements and trends to understand the momentum and performance of altcoins in the market. This factor helps identify periods of significant price appreciation or decline for altcoins.

C. Importance of ASI for Investors and Traders

The ASI provides valuable insights for investors and traders looking to optimize their altcoin investments. By tracking altcoin seasons, investors can make more informed decisions about portfolio allocation, entry and exit points, and risk management strategies. Traders can also utilize the ASI to identify potential trading opportunities and capitalize on market trends.

II. Components of the Altcoin Season Index

A. Market Capitalization of Altcoins

1. Explanation of Market Capitalization and Its Significance

Market capitalization serves as an important indicator of a cryptocurrency’s size and value within the market. It provides insights into the overall investor sentiment and the level of interest in a particular cryptocurrency.

2. Calculation of Altcoin Market Capitalization

Altcoin market capitalization is determined by multiplying the circulating supply of each altcoin by its respective price. The ASI compares the combined market capitalization of altcoins to Bitcoin’s market capitalization to assess the relative strength of altcoins during altcoin seasons.

B. Altcoin Dominance

1. Definition and Calculation of Altcoin Dominance

Altcoin dominance measures the proportion of altcoin market capitalization compared to the total cryptocurrency market capitalization. It is calculated by dividing the market capitalization of altcoins by the sum of altcoins’ market capitalization and Bitcoin’s market capitalization.

2. Significance of Altcoin Dominance in Determining Market Trends

Altcoin dominance provides insights into the market sentiment and preference for altcoins over Bitcoin. Higher altcoin dominance suggests increased interest in altcoins, indicating a potential altcoin season and a shift in investor focus. Conversely, lower altcoin dominance may indicate a stronger Bitcoin dominance and a bearish sentiment towards altcoins.

C. Altcoin Trading Volume

1. Explanation of Trading Volume and Its Importance

Trading volume represents the total number of altcoins being bought and sold within a specific period. It reflects the level of market activity, liquidity, and investor interest in altcoins. Higher trading volumes indicate increased participation and a higher likelihood of price movements.

2. Calculation of Altcoin Trading Volume

Altcoin trading volume is calculated by summing the trading volumes of all altcoins traded on various cryptocurrency exchanges. The ASI considers the overall trading volume of altcoins to determine the level of market activity and investor sentiment.

D. Altcoin Price Movements

1. Analysis of Altcoin Price Movements and Trends

Altcoin price movements provide insights into the performance and momentum of individual altcoins. The ASI analyzes historical price data, identifies patterns, and examines trends to assess the strength of altcoin seasons. Significant price appreciation or decline may indicate the beginning or end of an altcoin season.

2. Calculation and Interpretation of Altcoin Price Movements

The ASI calculates and tracks the price movements of altcoins using various technical indicators such as moving averages, relative strength index (RSI), and trend lines. These indicators help identify bullish or bearish trends, potential support and resistance levels, and the overall market sentiment towards altcoins.

III. Interpretation of the Altcoin Season Index

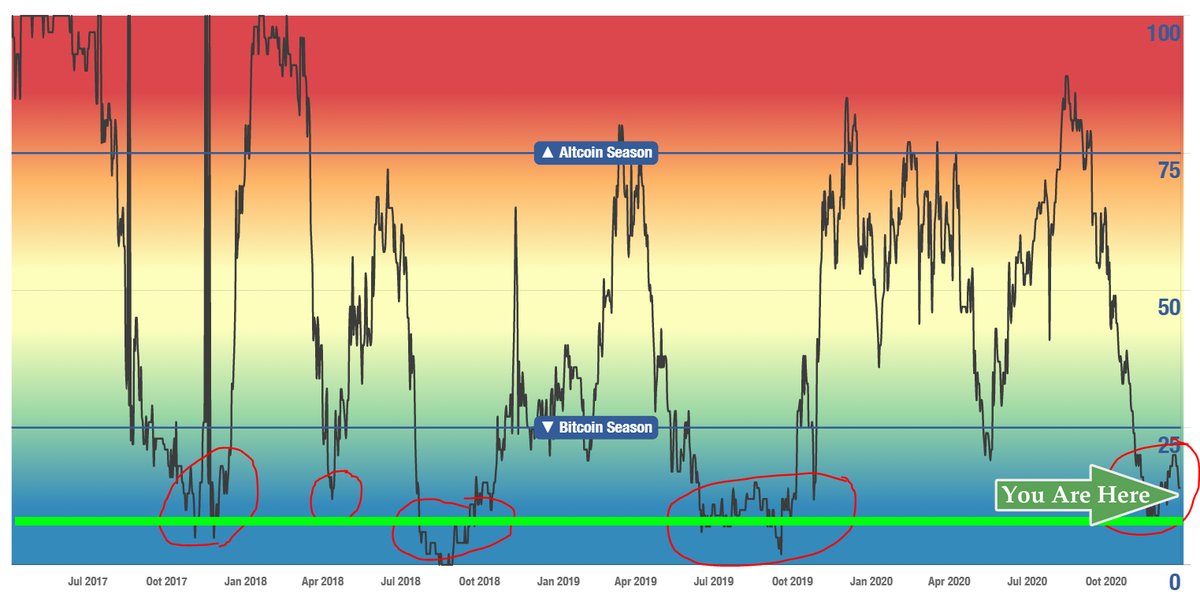

A. Explanation of the ASI Score and Its Range

The ASI score is a numerical representation of the strength and intensity of altcoin seasons. It ranges from 0 to 100, with higher scores indicating a stronger altcoin season. A score of 0 suggests a bearish market sentiment towards altcoins, while a score of 100 signifies a highly favorable environment for altcoin investments.

B. Interpreting High ASI Scores

1. Indicators of a Potential Altcoin Season

High ASI scores suggest a favourable market environment for altcoins. This may be characterized by increased altcoin market capitalization, higher altcoin dominance, robust trading volumes, and significant price movements. These indicators signify a potential shift in investor focus towards altcoins, presenting opportunities for investors and traders.

2. Strategies for Investors and Traders during Altcoin Seasons

During altcoin seasons, investors may consider increasing their exposure to altcoins, diversifying their portfolios, and identifying promising altcoin projects with strong fundamentals. Traders can leverage the momentum and volatility of altcoins to implement short-term trading strategies such as swing trading, breakout trading, or trend following.

C. Interpreting Low ASI Scores

1. Indicators of a Bear Market or Low Altcoin Activity

Low ASI scores indicate a bearish sentiment towards altcoins or a market environment where altcoins are not performing strongly compared to Bitcoin. This may be characterized by lower altcoin market capitalization, reduced altcoin dominance, lower trading volumes, and stagnant or declining altcoin prices.

2. Strategies for Investors and Traders during Bear Markets

During bearish periods, investors may consider reducing their exposure to altcoins and reallocating their portfolios to more stable assets such as Bitcoin or stablecoins. Traders can explore short-selling opportunities or adopt defensive trading strategies to mitigate risks during market downturns.

WATCH THE VIDEO BELOW FOR MORE CLARIFICATIONS.

IV. Limitations and Risks of the Altcoin Season Index

A. Discussion of Potential Limitations and Biases

The ASI, like any metric, has certain limitations and potential biases. These include the reliance on accurate and reliable data from cryptocurrency exchanges, the exclusion of newly launched altcoins with limited historical data, and the potential impact of market manipulations on the calculated values.

B. Market Risks and Factors That May Influence Altcoin Seasons

1. Market Risks

Altcoin seasons are subject to various market risks that can impact their performance. These risks include regulatory changes, market manipulations, security breaches, technological vulnerabilities, and macroeconomic factors. It is important for investors and traders to stay informed about these risks and adjust their strategies accordingly.

2. Factors Influencing Altcoin Seasons

Altcoin seasons can be influenced by several factors, including technological advancements, adoption and integration of blockchain technology, new altcoin listings on exchanges, partnerships and collaborations, market sentiment, and overall cryptocurrency market trends. Understanding these factors can provide valuable insights into the timing and potential duration of altcoin seasons.

C. Importance of Additional Research and Analysis

While the ASI provides a quantitative assessment of altcoin seasons, it should be used in conjunction with comprehensive research and analysis. Investors and traders should consider the fundamental analysis of altcoin projects, technical analysis of price charts, and staying up-to-date with market news and developments to make well-informed decisions.

Summary

A. Recap of the Altcoin Season Index and Its Significance

The Altcoin Season Index (ASI) is a valuable tool for investors and traders in the cryptocurrency market. By considering factors such as altcoin market capitalization, altcoin dominance, altcoin trading volume, and altcoin price movements, the ASI provides insights into altcoin seasons, helping individuals make informed investment decisions.

B. Implications for Investors and Traders

Understanding altcoin seasons and utilizing the ASI can have significant implications for investors and traders. It allows for strategic portfolio allocation, timely entry and exit points, and effective risk management strategies. By capitalizing on altcoin seasons, individuals can maximize their potential returns in the dynamic cryptocurrency market.

Conclusively, the Altcoin Season Index (ASI) serves as a valuable tool for understanding and utilizing altcoin seasons in the cryptocurrency market. By considering factors such as altcoin market capitalization, altcoin dominance, trading volume, and price movements, the ASI provides investors and traders with valuable insights to optimize their investment strategies. As the cryptocurrency market continues to evolve, ongoing improvements to the ASI, such as incorporating sentiment analysis, fundamental analysis, and expanding altcoin coverage, can further enhance its effectiveness in identifying altcoin seasons and facilitating informed decision-making.

Latest

Altcoins

21 Feb 2026

Altcoins

13 Feb 2026

Altcoins

07 Feb 2026

Altcoins

06 Feb 2026

Altcoins

05 Feb 2026

Altcoins

03 Feb 2026