James Carter

How to Invest in Web3: A Comprehensive Guide

The world of digital assets and decentralized finance has been rapidly expanding over the past few years, and the development of Web3 technology has brought new opportunities for investment and growth. In this article, we’ll explore the fundamentals of Web3, the potential of Web3 investment opportunities, and how to get started with investing in Web3.

WATCH THE VIDEO BELOW FOR MORE UNDERSTANDING

What is Web3?

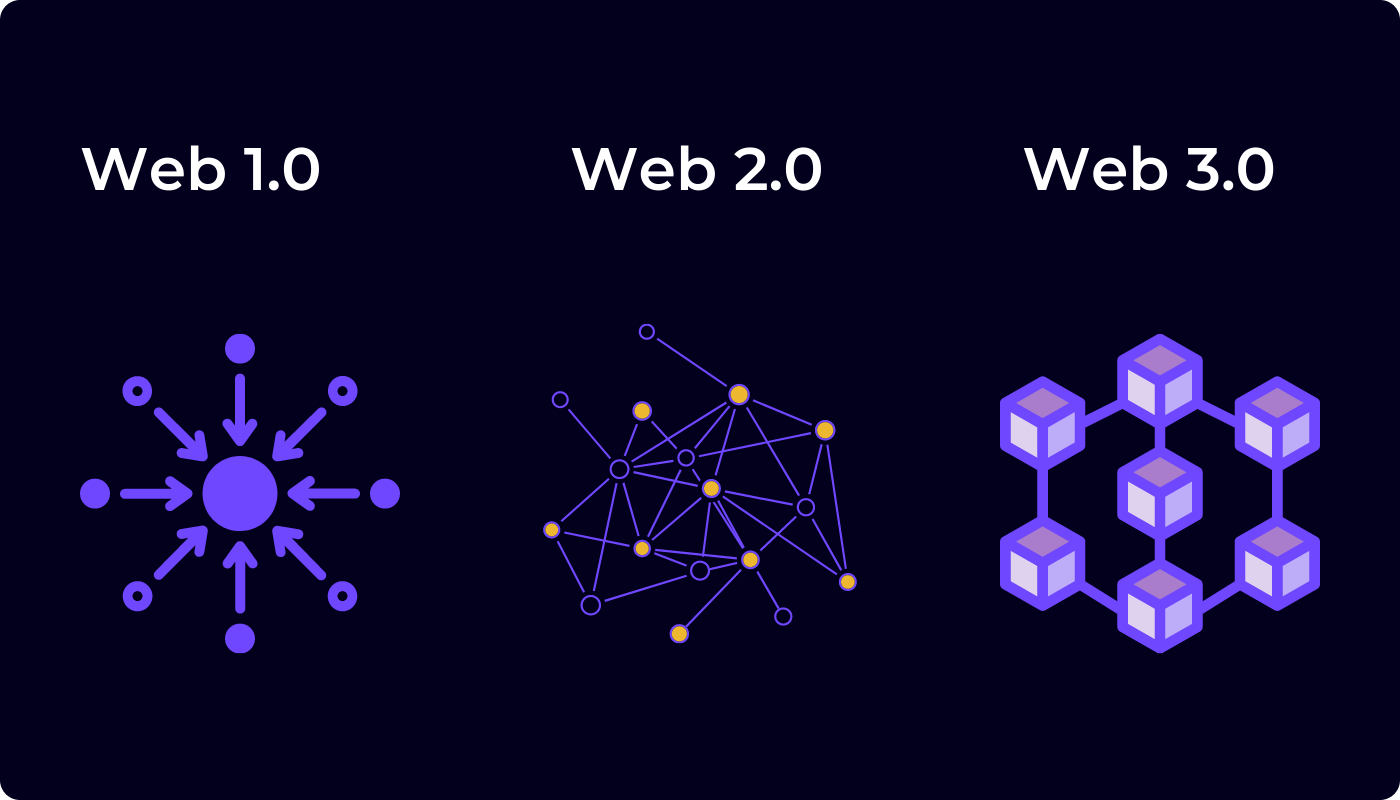

Web3 is the name for the next version of the internet, in which decentralization and user ownership will be the main goals. This new era of the internet aims to restore control to the users, as opposed to the central authorities that govern the current internet.

Web3 is built on blockchain platforms, which makes it possible to make decentralized applications (dApps) that run on a network of computers instead of a central server. This new way of making and using technology is changing how we use the internet and giving people who understand how it works a lot of ways to invest their money.

Overview of Web3 Investment Opportunities

Web3 investment opportunities come in many forms, including decentralized applications, protocols, and platforms. These investments are built on blockchain technology and aim to provide more secure, transparent, and efficient solutions to traditional web applications. Some popular examples of Web3 investment opportunities include decentralized exchanges (DEXs), non-fungible tokens (NFTs), and decentralized finance (DeFi) platforms.

Investing in Web3 can be highly rewarding, but it also requires a certain level of risk tolerance and technical understanding. It is essential to conduct thorough research and due diligence before investing in any Web3 opportunity. In this article, we’ll discuss the key considerations for investing in Web3.

- Research and Due Diligence

Before investing in Web3, it’s crucial to understand the underlying technology, evaluate the project’s team and partners, assess the project’s potential for growth and adoption, and review the project’s financials and token economics.

- Understanding the Underlying Technology

The first step in investing in Web3 is to understand the underlying technology and the potential impact it could have on various industries. This means researching the blockchain platform that the investment is built on, the consensus mechanism it uses, and the scalability solutions it has in place.

- Evaluating the Project’s Team and Partners

The next thing that needs to be done is an investigation of both the team working on the project and the partners involved. Look for experienced individuals in the fields of programming and marketing, as well as business executives that have a demonstrated history of success in the industry. You need to look at their LinkedIn profiles to figure out if they have any previous experience working in the blockchain or technology industries. If they have, then you should hire them. It is also helpful to examine the relationships that have been created for the project because these connections can offer further credibility and attention to the work that is being done.

- Assessing the Project’s Potential for Growth and Adoption

It’s crucial to assess the project’s potential for growth and adoption. Look for projects that have a strong user base, are well-positioned to solve real-world problems, and have a roadmap that outlines their goals and milestones. Additionally, consider the project’s competitive landscape, as this can provide insight into the potential for market dominance.

- Reviewing the Project’s Financials and Token Economics

Finally, it’s important to review the project’s financials and token economics. This includes evaluating the project’s token supply and distribution, as well as any incentives that may be in place for token holders. It’s also important to consider the project’s current market capitalization and its potential for growth.

- Choosing the Right Web3 Platforms

Once you have conducted your research and due diligence, it’s time to choose the right Web3 platform for your investment. In this section, we’ll compare popular Web3 platforms and discuss the difference between centralized and decentralized exchanges.

Comparison of Popular Web3 Platforms

There are several popular Web3 platforms, each with its own unique features and benefits. Some popular examples include Ethereum, Binance Smart Chain, and Polkadot. Every platform got its own advantages and disadvantages, and it’s important to choose the one that best fits your investment goals.

Ethereum is the most popular Web3 platform and has been around since 2015. It’s the home of many decentralized applications and has a robust ecosystem of developers and users.

Binance Smart Chain is a high-performance blockchain platform that’s built for decentralized finance applications. It’s compatible with Ethereum, which makes it easy for developers to build and deploy their projects on the platform.

Polkadot is a multi-chain platform that aims to provide interoperability between different blockchain networks. This makes it possible for users to transfer assets from one blockchain to another without having to go through a centralized exchange.

Understanding the Difference Between Centralized and Decentralized Exchanges

Before choosing a Web3 platform, you need to have a good grasp of the differences between centralized and decentralized exchanges. Decentralized exchanges are run on a network of computers and are not controlled by a single entity, in contrast to centralized exchanges, which are owned and administered by a single business. Centralized exchanges are also known as centralized trading platforms.

Centralized exchanges make trading more efficient and permit trading in a wider variety of assets, but they are also vulnerable to hacking, which could result in the loss of capital. On the other side, decentralized exchanges provide a higher level of safety and transparency, but they may have smaller trading volumes and longer wait times before trades can be executed.

How to Invest in Web3

Once you’ve chosen a Web3 platform, it’s time to start investing in Web3 projects. There are several options for investing in Web3, including buying and holding Web3 tokens, participating in staking and liquidity provision, and trading Web3 tokens on decentralized exchanges.

- Buying and Holding Web3 Tokens

One of the most straightforward ways to invest in Web3 is to buy and hold Web3 tokens. This involves purchasing the token of a project you believe in and holding it for a longer period of time in order to potentially realize gains as the project grows and develops. It’s vital to remember that the value of a token can be highly volatile, so it’s essential to only invest what you can afford to lose.

- Participating in Staking and Liquidity Provision

Staking and liquidity provision are two popular investment strategies in the Web3 space. Staking includes holding a certain amount of a token in a wallet and participating in the validation of transactions on the blockchain. In return, stakers are typically rewarded with a portion of the fees generated by the network.

Liquidity provision involves providing liquidity to a decentralized exchange by depositing funds into a smart contract. This allows traders to buy and sell assets on the exchange, and in return, liquidity providers are rewarded with a portion of the fees generated by the exchange.

- Trading Web3 Tokens on Decentralized Exchanges

Another option for investing in Web3 is to trade Web3 tokens on decentralized exchanges. This involves buying and selling tokens on a decentralized exchange in an effort to realize gains from price fluctuations. It’s vital to keep in mind that trading is highly speculative and requires a good understanding of market dynamics and technical analysis.

- Risk Management

Investing in Web3 comes with its own set of risks, and it’s essential to have a solid risk management strategy in place. This includes understanding the volatility of Web3 assets, diversifying your investment portfolio and regularly monitoring the performance of your investments.

- Understanding the Volatility of Web3 Assets

Web3 assets are highly volatile, and their value can fluctuate rapidly. This is happening because of a number of reasons, such as the way the market feels, changes in regulations, and improvements in technology. It’s important to understand the potential for large price swings before investing in Web3 assets and to be prepared for the possibility of losing money.

- Diversifying Your Investment Portfolio

Diversifying your investment portfolio is another important aspect of risk management. This involves spreading your investments across different Web3 platforms and projects, as well as investing in traditional assets like stocks, bonds, and commodities. This can help to reduce the impact of any losses and increase the stability of your investment portfolio.

- Monitoring the Performance of Your Investments

Regularly monitoring the performance of your investments is an essential part of risk management. This involves staying informed about the latest developments in the Web3 space, tracking the performance of your investments, and adjusting your investment strategy as necessary. It’s also important to have a clear exit strategy in place so that you can sell your investments if necessary to minimize losses.

Conclusion

Investing in Web3 is an exciting opportunity to participate in the development of decentralized technology and to potentially realize financial gains. However, it’s important to understand the risks involved and have a solid risk management strategy in place. By carefully researching the various Web3 platforms and projects, diversifying your investment portfolio, and regularly monitoring the performance of your investments, you can increase the chances of success and minimize the risks associated with investing in Web3.

Latest

Technology

21 Feb 2026

Technology

13 Feb 2026

Technology

07 Feb 2026

Technology

06 Feb 2026

Technology

05 Feb 2026

Technology

03 Feb 2026