Coinposters

How to Analyze Cryptocurrency and Its Price?

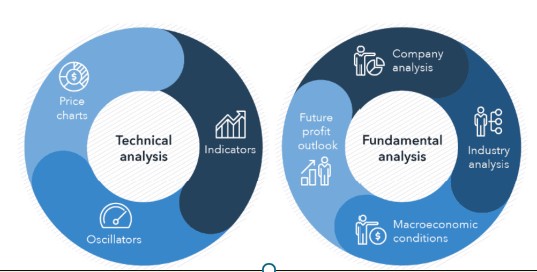

Trading cryptocurrencies requires knowledge and skills due to their high price volatility. As part of acquiring the right knowledge relating to a particular cryptocurrency, an investor should carry out thorough research using technical analysis and crypto fundamental value analysis. This article will cover how to analyze cryptocurrencies using fundamental analysis.

What is fundamental analysis?

Fundamental analysis is the process of determining the intrinsic value of an asset such as cryptocurrency through evaluating various factors like the project’s whitepaper. The aim of fundamental analysis of crypto is to establish whether a cryptocurrency is overvalued or undervalued. This involves evaluating the internal and external factors that influence the value of the asset.

traders who use fundamental analysis to analyze cryptocurrencies become better positioned to identify suitable market entry and exit points. However, it is essential to use technical analysis alongside fundamental analysis.

Fundamental analysis crypto focuses on three key aspects namely project metrics, financial metrics, and on-chain metrics. Most of these crypto indicators enable investors to make informed decisions that enhance their chances of getting high returns.

Project metrics

Project analysis deals with qualitative analysis of factors that affect the performance of a cryptocurrency such as whitepapers, project teams, the communities, and tokenomics.

Whitepaper

Probably the most important document which established crypto projects have is the whitepaper which explores their objectives and visions, among others. This document should explain the problem that the project aims to solve and how it intends to achieve that. It also gives an explanation of how the technology works and how the project differs from its competitors.

Specifically, the document should discuss the cryptocurrency’s use cases, features, and planned upgrades as well as the team behind the project.

Research on Project team

Crypto projects have teams that comprise developers, founders, and other technical specialists who are responsible for running the project. It is important to know and understand the backgrounds of the various team members to ascertain if they can succeed in their mission. Therefore, the investors can research each team member and tell if he/she has the appropriate knowledge, skills, and experience.

It is essential to find out if the team members have track records of past successes in similar projects. This is because a project is as good as its team members. It is also vital to avoid investing in projects where the team members have no traceable track records.

Understand and engage with the community

Since cryptocurrencies are community-driven, every investor should work hard to acclimatize with them. This is because the community is the backbone of the project and cryptocurrency. Through this process, you come to understand whether or not the cryptocurrency has utility and the required fundamentals. This is because when the community members discuss the project on social platforms you can gauge its prospect.

Many crypto projects establish their social media groups and chat rooms on Telegram, Discord, Twitter, and Facebook. Therefore, the investor can join these groups and channels and participate in the deliberations. A point, promising project should have a large base of followers and participants.

Research the project reputation

The reputation of a crypto project is important for its success since it attracts many investors. Every potential user should research the project team, vision, and leadership as they give clues on a project’s potential future progress. As discussed, you get greater details about the project by following the engagement of other users on social media platforms. One can also check on the project’s reviews, press releases, and publicity.

Learn the tokenomics

It is vital to understand the tokenomics of a cryptocurrency before investing in it. The reason is that it helps you to anticipate the coin or token’s demand and supply which in turn affects its value. In simple terms, tokenomics means the study of the demand and supply of a cryptocurrency.

In reality, an asset whose demand is greater than its supply will have a high value. On the other hand, its demand depends on its use cases. That is the reason why an investor should understand the value proposition of the crypto project. A project with high utility or a unique mission will attract many investors and supporters.

There are key aspects that a potential investor should know about a cryptocurrency such as its circulating supply, total supply, and maximum supply since they influence its price.

The distribution of the cryptocurrency among key players such as investors, the team, and the community is indicative of its potential performance on the market. For instance, it is not a good sign if the team has a large share of the token or coin as that shows greediness on their part.

Review the roadmap

The roadmap is a list of planned events, upgrades, and releases such as testnets that the crypto project will carry out within specified time frames. Usually, the team suggests quarter-yearly time frames for these expected crucial events and stages. A roadmap helps the investors to check the progress that the project is making toward its ultimate goals.

Financial metrics

The financial metrics are part of the crypto fundamental value analysis that deals with the performance of the cryptocurrency on the market. They include trading volume, liquidity, market capitalization, and supply mechanism.

Market capitalization

There is no doubt that a cryptocurrency’s market capitalization is one of its key metrics as it points to its potential growth. We obtain an asset’s market capitalization by multiplying its circulating supply by the price. However, there are various crypto analytic tools and websites which publish market capitalizations of various cryptocurrencies. The market leaders in this category are CoinGecko and Gate.io, where you can visit and search for the latest market caps and the latest crypto prices of the cryptocurrencies of your choice.

In general, the higher the market capitalization the safer it is to invest in it. Nevertheless, it is best to use a token’s market capitalization alongside other cryptocurrency indicators when evaluating its growth potential.

Supply mechanism

Investors should also analyze the cryptocurrency’s supply mechanism which includes its circulating supply, the total supply, maximum supply as well as the rate of inflation which all have a bearing on its price.

The circulating supply refers to the total number of tokens or coins which are in circulation at any time. Nevertheless, the supply of cryptocurrencies can change over time when some blockchains produce more tokens while others burn them. An increase in the number of circulating tokens may lead to a fall in their prices. Conversely, a decrease in the circulating supply can lead to a rise in the value of a cryptocurrency.

Liquidity and volume

The liquidity and trading volume of a cryptocurrency can determine the actions investors can carry out in the market. Liquidity refers to how easy it is to buy or sell a cryptocurrency. On the other hand, the trading volume is the number of tokens or coins that people trade within a given period, say 24 hours.

In most cases, a trading platform that has a high trading volume is also very liquid. All other things being equal, it is best to invest in a cryptocurrency with high liquidity and trading volume. One strong coin test is to relate the change in price to the trading volume. For example, if both the price and the trading volume of the asset are rising it is an indication of sustainable trading momentum.

On-chain metrics

On-chain metrics relate to quantitative data about a cryptocurrency that we can easily access on the blockchain. There are various websites where you can find such types of data, for instance, blockchain explorers. Examples of such metrics are transaction values, active addresses, fees paid, transaction count, and hash rate.

Transaction value

Transaction value is a metric that shows the on-chain value of a transaction such as BTC. In other words, it indicates the value of a transaction that occurs within a specific period. It is very important to choose a good cryptocurrency exchange that provides correct and real-time updated cryptocurrency prices like BTC or ETH etc., such as Gate.io crypto exchange is a good one.

For instance, if there are ten transactions involving Bitcoin with a current market price of $16,000, the transaction value is $160, 000. Investors prefer cryptocurrencies that consistently record high transaction values over those that have lower ones.

Transaction count

The transaction count refers to the total number of transactions within a specific period such as a second, hour, or day. Most blockchains use transactions per second (TPS) when referring to their speed. Crypto networks with high transactions per second are preferable than the ones with low TPS.

Active addresses

As the name suggests, active addresses are the total number of wallet addresses that have been part of transactions within a period. These include the wallets that have sent or received the cryptocurrency. This metric is important to detect whether the addresses are increasing or decreasing.

If the number of wallets is increasing it means that more people are interested in cryptocurrency. On the other hand, a decrease in the number of blockchain addresses means the cryptocurrency may be losing momentum.

Fees paid

A blockchain’s network fees to indicate the level of demand for its product and the cryptocurrency. Therefore, if you observe that the transaction fee is increasing over time it means that the demand for the token is also rising. However, some networks are designed to have higher gas fees than others.

In the case of proof of stake blockchains, the high fee also indicates that the network is secure since there are many miners who are involved. Therefore, many investors would like to put their funds in a secure cryptocurrency.

Hashrate and staked tokens

Blockchains do not use one type of consensus mechanism. However, most networks use the proof-of-stake or proof-of-work algorithms. The proof-of-work consensus mechanism uses computing power, measured in hash rate, to verify transactions. A network’s hash rate shows the health state of the blockchain. Attackers find it very difficult to exploit a network that has a high hash rate because it is secure.

On the contrary, a decrease in the hash rate means that many miners are shunning the network which can lead to minor capitulation as they may be making losses or generating very little profit. With a proof-of-stake blockchain, a rise in the quantity of staked coins means that the security of the blockchain is increasing. On the other hand, a network with a small amount of staked tokens is prone to malicious attacks.

Conclusion

Cryptocurrency fundamental analysis, also called crypto fundamental value analysis, is a process of determining whether a token or coin is overvalued or undervalued. For example, investors can use on-chain analysis to find if Bitcoin is overvalued. They include transaction value, transaction count, fees paid, and active addresses. Both long-term and short-term investors should know how to analyze cryptocurrency.

Latest

News

03 Feb 2026