Coinposters

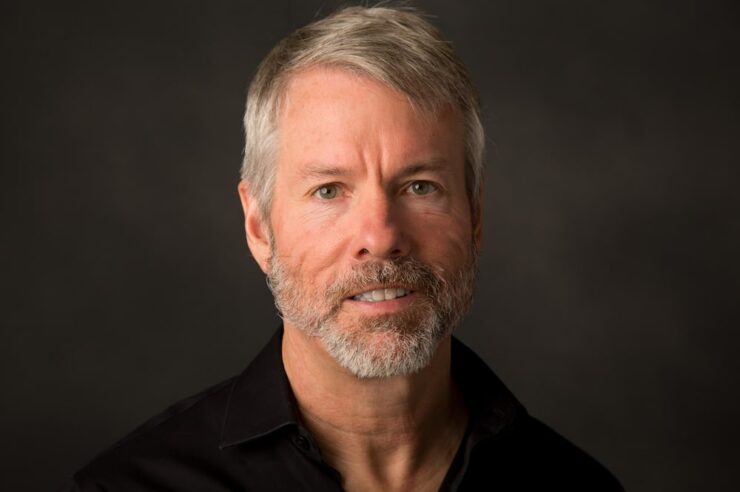

The United States Is Charging Michael Saylor For Tax Evasion

Attorney General of Washington, D.C. Karl Racine stated on Wednesday that the Office of the Attorney General (OAG) has filed civil charges for failure to pay income taxes against Bitcoin advocate Michael Saylor and his firm MicroStrategy.

The computer mogul reportedly evaded paying more than $25 million in taxes by claiming to reside in an area with lower income taxes than Washington, D.C.

The U.S. Attorney’s Office observed that the defendant had resided in the District for more than a decade without paying the requisite income taxes. According to the District’s order, people who own properties and residences in the area for at least 183 days are required to declare income taxes and cooperate with the authorities.

However, the defendant violated the regulation by appearing to reside in Florida, a state without income taxes, while spending the most of his time in Washington, D.C.

OAG said that he gave false information to local and federal tax officials in order to misrepresent his residence and avoid D.C. tax penalties.

The lawsuit also alleges that Saylor has publicly referred to Georgetown as his home since 2005, noting that he resides in a 7,000-square-foot waterfront condominium. He also own more opulent assets, including two boats.

Attorney Racine further noted that the OAG is suing Saylor’s business intelligence firm MicroStrategy for allegedly collaborating with its founder to “evade taxes on hundreds of millions of dollars he legitimately owes while residing in D.C.”

According to OAG, the company has extensive evidence establishing Saylor’s D.C. residency.

The court also highlighted that this is the first case filed under the newly enacted False Claims Act in the District (FCA).

The new rule permits courts to penalize tax evaders with “treble damages,” or three times the amount of tax avoided. The newly revised FCA also encourages whistleblowers to report tax evaders accused of misrepresenting their D.C. residency.

Latest

News

31 Aug 2023

News

24 Jun 2023

News

24 Jun 2023

News

23 Jun 2023

News

16 Jun 2023